Hi, I’m Evan Bleker.

Investment profits are extremely elusive – especially if you don’t have a solid strategy. That’s why I chose a strategy that has been proven to work exceptionally well both in academic studies and in practice for over 100 years. I’m talking about Ben Graham’s classic net net stock strategy – a strategy shown consistently to earn returns above 25% per year.

To be honest with you I’m normally very skeptical of any “strategy” so it took me a long time to finally wake up to how good Ben Graham’s recommendation actually was. His strategy is based on simple principles of value that are easy to apply, but you have to supply the temperament and cash yourself…

Of course, finding stocks that fit his metrics can be extremely challenging which is why I started this membership site.

Let’s get to that in a bit. Right now, I think it’s important to let you know just what I’m offing people who are ready to make net net stocks a key part of their portfolio.

So, why would you want to join?

- Gain access to 540 international Net Net Stocks on the NYSE, NASDAQ, TSX, TSX.V, LON, and ASX.

- Quickly identify top investment candidates in each market using our Investment Shortlists.

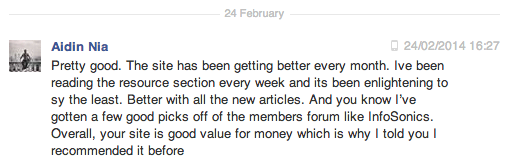

- Sharpen your skills with academic studies and articles from major investors, such as Greenblatt and Buffett, in our Resource Center.

- Connect with other deep value investors and share ideas or insight on our Community Forum.

If the returns are so good – why would I want to share? Well, it all started with an experiment nearly ten years earlier...

Fiberglass dust is an amazing teacher.

You're frustrated.

You feel like success is slipping through your hands.

You know you can make money in stocks but you need the opportunity.

That's a desperate picture, isn't it? ...and it's exactly where I was early 2010.

Fresh out of high school, I was itching to earn some real money to get my butt behind a stunning Jeep TJ. I fantasized about its deep blue pearl paint, its leather-stitched seats, about splashing its enormous tires through shallow rivers in the British Columbian interior. I was totally and completely captivated - so I dragged myself out of bed at 5 am every-single-morning and fought through brutal traffic for an hour-and-a-half to get to my job at a small fiberglass shipyard.

I hated every moment of it - the choking fiberglass dust which stuck into your skin like a million tiny needles, the soul-sucking heat that left you absolutely exhausted, the mind-numbing boredom of sweeping the same 200' x 200' square for 8 hours a day, 5 days a week, every week for an entire year. Each morning after forcing myself from bed, though, I passed a magazine cut-out of a perfect Jeep TJ that I had pinned to my bedroom door. Seeing that amazing truck's massive rubber tires crawling over large wet boulders gave me enough determination to get through another day.

FINALLY, a year later my bank account was swollen with cash and I could actually buy my dream truck outright.

I should have been happy.

Instead, all I could think about was the horrific amount of pain I had endured over those long... long... 12 months.

The Jeep was not worth all of that. The thought of parting with my cash made me feel hollow. It just... wasn't worth it. I knew I had to put my money to work for me, instead.

What's the best way to LOSE all of your money in stocks?

The smug financial assistant at my bank didn't exactly want to help. She pulled out a few sales sheets full of questionable investment products - mutual funds showing 7-8% yearly returns with huge price swings from year to year. In the world of investing, these were complete junk.

That's when I learned my first valuable investment lesson: in the world of finance, everyone you talk to is a salesman. Of course, there's nothing wrong with selling, but what really pisses me off - what really makes my blood boil - is that most people in the financial industry are selling products that can seriously damage your financial future ...and they just don't care about it!

In the world of finance, you have to trust yourself.

I left the bank completely frustrated ...and angry about how little that woman cared about something I had worked so hard for. I knew I had to do things myself, so I immediately dove neck deep into investment books, desperately trying to learn as much as I could.

I was terrified. With the amount of cash I had sitting there each financial decision I made was vitally important. I imagined my entire savings, all of the money I had suffered for, just... melting away as my investments sank.

The best place to start, I figured, was studying the greats. I read about Peter Lynch and Warren Buffett. I read about Benjamin Graham. I started to amass a wealth of knowledge that most people just totally ignore - futures exchanges, balance sheets, limit orders, preferred shares - and even enrolled in university classes, hungry for more. I got way too engrossed in learning about investing - far beyond any healthy level of study.

But I made a devastating error.

If you actually found and stuck with Benjamin Graham when you first started out - you don't know how lucky you are.

Graham was one of the few people who really cared about the average investor and one of the only guys in finance with a solid investment philosophy. Unfortunately, I came late to the party.

I read about Graham's great track-record early on, so dug deeper. I noticed that he loved what he called "net nets stocks." These stocks were incredibly cheap, and incredibly profitable - providing outstanding returns of 20-30% a year! I was ecstatic and jumped onto Google to learn more... ...only to read article after article talking about the extinction of net net stocks. Deflated, I moved on.

A month later I was upstairs in my room flipping through the pages of one of my investment books. Just over half way through the book, on the left side of the page, I noticed an interesting website name. Looking a bit closer I saw that a fantastic looking long term record had been scribed into the page next to it.

A powerful sense of optimism swept through me. I'm sure you've felt the same way before, maybe after getting a great job. It's that feeling of hope that comes when you just know that things are going to work out after all. I was finally set.

Over the course of two years I watched my stock account slip by hundreds of dollars a month, eventually eroding to nearly half its earlier value. Soon I started asking questions - how good were these guys, really? Could I verify their record? Turns out the pair behind the website were great marketers but lousy investors. My questions started to turn up articles critical of them, articles that called their investment prowess into question and punched large holes in their investment record.

I FELT ABSOLUTELY SICK. Horrified, my chest tightened. It was hard to breath. Imagine watching your ENTIRE portfolio whither away because you followed the advice of conmen!

Not doing in depth research on their investment style was one of the most foolish things I had ever done. No matter how you chose to invest, you have to make sure that your particular style has been proven to work over the long term.

A Simple Path to Millions $$$

Investing is simple, but it's not easy. I shifted to Peter Lynch and Warren Buffett, two outstanding investors, but didn't come close to matching their business understanding or the amount of time they spent researching individual companies. Lynch even traveled from head-office to head-office talking to top level executives.

Visiting head-offices and talking to management was clearly out of the question, but other statistical investment methods seemed just as tricky to use. Low P/E, while simple in theory, often has very serious complications. What if the company had a large one-time windfall? If I used average earnings over a series of years, how would I know that the company's current weak earnings would rebound? Should I account for cash/debt levels or just use the plain vanilla approach? These were very real problems that had to be dealt with.

After years of work and frustration I was totally depressed. Investing turned out to be really tough. I felt like an idiot for thinking I could do decently in stocks. I was convinced that liquidating and buying an index fund was the answer.

Then by chance sitting at the computer one Saturday afternoon I googled Benjamin Graham's net net strategy one last time. It had been years since I first read about them. To my surprise, I found two investors who were actively investing in net net stocks.

I rushed back upstairs, pulled down one of Benjamin Graham's books and skimmed through the index looking for the handful of pages containing information about net net stocks. Net nets, he wrote, were the easiest and most profitable way to make money in stocks. Not only that, they were a safe way of earning a tremendous amount of money.

Ensuring I didn't make the same costly mistake I made years before, I knew I had to learn more.

I dove full force into studying net net investing. I combed through all of Ben Graham's books for information, sucked what I could out of academic journals testing his investment technique, and even totally dissected Warren Buffet's partnership letters.

I was ECSTATIC! Graham's approach to investing was just as good as I originally though!

Within a couple months I had purchased a number of stocks and a year later my portfolio was showing good returns. Quarter by quarter I watched my portfolio inch upwards. Soon my portfolio had earned back all of the money I lost.

FINALLY, I had an outstanding well tested investment philosophy that had been used by legendary investors for years and was simple to understand and appy.

Your Portfolio is DEAD

Those articles that turned me off net net stocks initially were only half right. It's very hard to find net nets during market peaks, when stocks have rushed skywards and even your grandmother is talking about selling her car to get into the market.

I don't want to sound condescending because I know how intelligent and hard working value investors are - but if you don't have access to the best investment opportunities within your niche then your portfolio is going nowhere. Your portfolio is DEAD. In net net stocks - as in all other types of investing - that means painstakingly combing through thousands of stocks to find a handful of golden opportunities.

It can be a long.... long.... tedious process.

Most investors aren't combing through stocks to find the best opportunities - and you can't blame them. Most investors are regular people. Smart? Sure... but still regular people. They have relationships and full time jobs. They have other demands that they just can't neglect.

But that doesn't change anything: if you don't have the time to search for the best investment opportunities than you have a SERIOUS PROBLEM.

It Takes One to Know One

I realized this fairly quickly. While my portfolio has done very well over the last few years, available net nets began to shrink quite a bit in 2012 and 2013.... there just weren't as many opportunities.

But that doesn't mean you couldn't put a great portfolio together - it just means that you have to look for opportunities in more places.

A great way to do this is to go international. The investment universe is heavily centered around New York . That's sad considering just how many countries have well developed capital markets - countries such as Canada, Britain, Australia, and Hong Kong have strong capitalist economies. They also have great value opportunities that haven't been picked over.

That's what really pushed me to invest internationally. I didn't want to spend hours and hours digging through company information to find a handful of firms to research, though. I wanted an easy way to screen for net nets to decide quickly which to research further and which to pass on.

When I mentioned building a stock screener to a couple of friends they were immediately on-board. Seeing the amount of growth I had gone through, they had a personal understanding of the type of knowledge I built and so were instantly on board when it came to international value investing.

But then one of them suggested something else. Instead of just build a screening tool that the three of us could use, why not make it available to other people who struggled to find a foothold like I did, years before.

Only 50 Subscriptions Available

I wasn't nuts about the idea at first, since I didn't like the idea of even more competition. Then it dawned on me: there are others out there who are driven to succeed in investing. There are smart dedicated Low Price to Net Current Asset investors who need these opportunities as much as I do.

(If you know anything about skilled value investors you know that they like to share ideas and help others more than any other type of investors. Maybe it's a culture that Benjamin Graham or Warren Buffett helped build, but value investing is as much a sharing and learning culture as it is anything else.)

By inviting others to use the stock screener I could help build a community that provides a tremendous amount of value to each and every member. By allowing access to the screener, other dedicated value investors can share invaluable research and, in turn, gain access to even more fantastic investment opportunities!

But I'm not going to open this group up to just anyone.

The value of any group comes only from its members. That's why I am limiting membership to those who are dedicated to making the best possible investment decisions, people who are focused net net investors. I'm not writing this for those who need convincing about NCAV investing - if you are on the fence when it comes to investing in Graham style net net stocks then close this page and return to your account at Investor's Business Daily.

This website is not for the fence-sitters. If this is you, please stop reading right here.

This group is only for those dedicated to net net investing, but I don't want too many people to join, either. There are only so many net net stocks available so more people means that members start competing for a handful of opportunities. No high value group can survive in that type of environment.

So this group is open to the first 50 people who apply. The first 50 ONLY!

...and to get the ball rolling, I'm going to drop the price right down to $0.00 for the first 9 days - that way you can get a sense of what the website is all about, and make an informed decision on whether to pay for membership or not. If you don't like the site then cancel within 9 days and pay nothing at all.... ever!

So what exactly is included?

Raw NCAV stock screens.

- Members had access to over 540 international Net Net Stocks at last count!

- Screens include NYSE, NASDAQ, TSX, TSX.V, LON, and the ASX -- 6 international markets with more to come as users request them.

Net Net Stock Shortlists.

- Hand-picked stocks from every market we cover so you can assess the best investment opportunities, faster.

- Using each company's actual financial statements, we calculate critical key ratios helping you narrow down the stocks you want to look at.

Net Net Hunter community forums.

- Community sourced investment ideas and research.

- Discuss stock ideas with other deep value investors.

- Information on: global Markets, Strategy and tactics, Behavioral Finance & Investor Psychology, and International Brokers.

A Membership Resource Center.

- Academic studies on net net investing highlighting expected returns in all market conditions and showcasing NCAV investing best practices.

- Articles written by world-class investors such as GreenBlatt, Graham, and Warren Buffett on investing, the market, and net net investing.

- Videos and articles from professional psychologists and investors discussing psychological pitfalls in decision making.

- Book reviews and recommendations so you can make the best use of your time when learning how to invest.

Direct contact with me so the site and community develops the way you want it to.

- Members have a strong say in the shape the website takes, including which markets are covered, the resources put together, and how the material is presented.

- As a member, you have my personal contact information and an ability to talk to me when you want.

Our monthly plan is 100% RISK FREE.

- FREE 9 day trial period where you can opt-out without paying anything.

- Cancel your monthly membership any time, for any reason, without further charges.

Finally, an investment site dedicated to Net Net Stock Investing.

All of this would have been incredibly valuable for me when I was initially starting out, and the ability to screen for international NCAV stocks is a must for any experienced investor who wants to maximize their time.

Typical "investment websites" charge north of $550 per year - and Value Line charges as much as $600 per year!

I was told to charge the same as other websites, but that's not fair. What I'm trying to build is a solid community of NCAV investors - and a lot of new investors only have a few thousand dollars to invest. I DON'T want to start gouging people just because some "investment websites" are - I'm talking about building community, after all.

After thinking about it for a long time I'm going to set the base price at $29.97/month.

But hold on! Like I said, my focus is putting together a group of people who are passionate about Net Net Investing, people who take their investments seriously. ...and I know that the most dedicated, the most passionate investors are only interested in high quality investment sites, so...

I'm going to give you the first 9 days absolutely free so you can see what the site is like before you decide to hand over any money. That's more than fair, right? Take a look ~

First 50 Subscribers!

Try it free for 9 days!

$29.97 per month

Subscribe as long as you like![s2Member-PayPal-Button level="1" ccaps="" desc="Net Net Hunter / 9 day free trial, $29.97/month" ps="paypal" lc="" cc="USD" dg="0" ns="1" custom="www.netnethunter.com" ta="0" tp="9" tt="D" ra="29.97" rp="1" rt="M" rr="1" rrt="" rra="1" image="https://www.netnethunter.com/wp-content/themes/echelon/images/xpinkbutton.png" /]

First 50 Subscribers!

Try it free for 9 days!

$249.97 per year

Pay at once for a $110 savings over monthly! [s2Member-PayPal-Button level="1" ccaps="" desc="Net Net Hunter / 9 day free trial, $279/year" ps="paypal" lc="" cc="USD" dg="0" ns="1" custom="www.netnethunter.com" ta="0" tp="9" tt="D" ra="249.97" rp="1" rt="Y" rr="1" rrt="" rra="1" image="https://www.netnethunter.com/wp-content/themes/echelon/images/xpinkbutton.png" output="button" /]

Masih Hosseini

/ MSc, Simon Fraser University

I signed up for the free net nets mid-autumn 2013. It has been a great way to get good stock ideas and learn more about investing. Evan seems focused on giving a good experience and I’ve never had spam.

Matthew Senicola

New York / Managing Partner, North Shore Wealth Management

I think you have the beginnings of a great site.

Blake Miner

Hong Kong / The Energy Life

Initially I was weary about joining but the nine day cancellation policy was reassuring. Evan is really personable and has helped me understand net net stocks and how to invest in them. His investment shortlists really help minimize the work necessary to put together a good portfolio.

Luis Cote

Doha, Dubai

The thought of financial independence before turning 40 had never crossed my mind. Then, I was lucky to meet Evan who has been offering guidance on how to invest. This is how I made a promise to myself to retire in under ten years. I now feel that my goal is within reach.

Mark Langenbacher

/ Remington College Business Department Chair, Hawaii

Excellent advice and source of knowledge on the stock market.

Zenas Hubbard

South Korea / zenashubbard.com

Netnethunter.com has been a super easy way for me to receive great investment ideas month to month without having to spend a lot of my own time on it doing all the research.

Unfortunately, nobody will be admitted after we reach 50 members.

Don't Wait. You Only Have One Life.

The sad fact is that we only have one crack at investing, only one life that we have to make the most of... and the earlier you can start making outsized returns the better off you'll be.

Don't waste this chance.