Should You Really Avoid Money Losing NCAV Stocks?

A lot of investors instinctively shy away from stocks of companies that are losing money. It's almost like avoiding red on income statements is an evolutionary reflex.

Over the years I've read a few articles from online magazines warning investors to stay away from NCAV stocks of companies that are bleeding red. Many of the authors talk about the potential that net net stocks have as investments, and how profitable investing in a basket of these companies are, but warn investors not to blindly invest in net net stocks to avoid facing serious losses. While I do think that investors should run their NCAV stock candidate through a checklist, a lot of these articles seem to avoid the actual track-record of money-losing NCAV stocks.

Should you stay away from NCAV stocks of companies that are losing money? Maybe. There are very few universal principles in the world of value investing strategy so how you should look at money losing NCAV stocks is not a clear cut yes or no. Let me explain.

Don't Avoid Money Losing NCAV Stocks

As a group, NCAV stocks of companies that lose money perform excellently.

I'm a big believer in just doing what works -- what has been shown to work, when using a little bit of critical thinking, through academic or institutional studies. I'm a value investor because of the track-record that value investing has, and I'm a net net stock investor specifically because of the returns that the strategy has shown. When developing my net net stock strategy I dove into all of the academic, peer reviewed, studies I could find in order to dissect the strategy to see what worked.

During my research I came across an interesting little tidbit in Oppenheimer's 1986 study of net net stocks. Oppenheimer looked at the performance of net net stocks from 1970 to 1983, a period that represented significant fluctuations in the stock market. The results, of course, were great -- net net stocks returned between 21% and 35% on average during the period depending on the size of stocks selected. Near the end of the paper Oppenheimer mentions that there is no real difference between NCAV stocks of profitable and unprofitable companies. In fact, he suggests that, if anything, NCAV stocks of unprofitable companies did slightly better than the rest.

Obviously this finding is not significant enough for you to go out and purposefully look for unprofitable net net stocks. What is significant, however, is the fact that unprofitable NCAV stocks did not underperform versus their peers. Oppenheimer's study strongly suggests that you will pass up high quality investment opportunities if you screen out money-losing firms.

Warren Buffett would have agreed. One of the most well known of his earlier investments was a firm called Dempster Mills. Dempster wasn't profitable, yet Warren Buffett bought it anyways. While he took nibbles at the stock previously, in 1961 he went full-in, obtaining majority control at a price a bit above $30/share. After infusing new management into the company, Warren Buffett's NCAV investment had ballooned to nearly $65/share.

My Own Experience With Money Losing NCAV Stocks

I have never avoided money-losing net net stocks. Instead, I set up a solid NCAV checklist using Benjamin Graham's own investment strategy, as well as the results found in actual academic studies which looked at NCAV stocks. As a result, a profitability requirement never made it onto the list and 17 of the 18 positions that I've held over the last 3 years have been NCAV stocks of money-losing companies.

I don't recommend that investors screen out money making net net stocks, stocks of profitable companies that are trading below NCAV, but I don't think excluding money-losing net net stocks will add to your portfolio returns, either. The great returns shown by my net net stocks portfolio show how well money-losing net net stocks can perform.

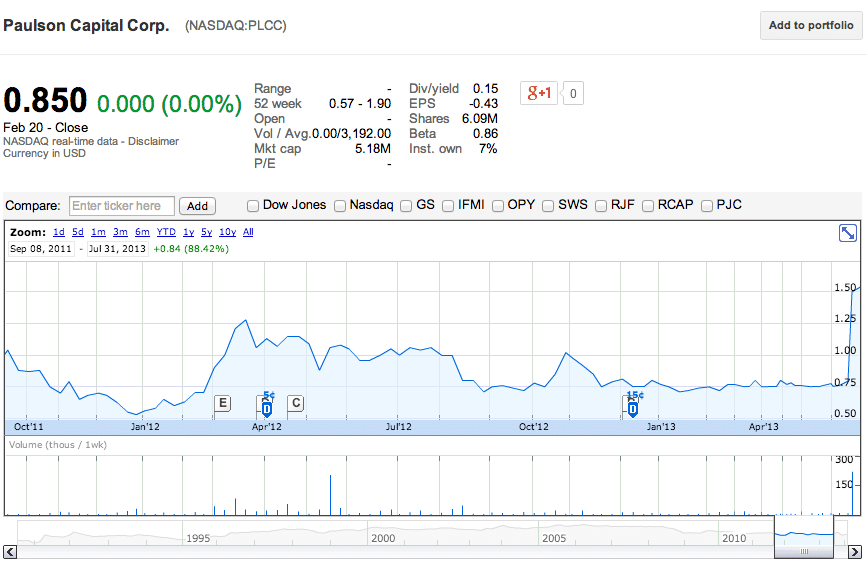

Take Paulson Capital Corp (NASDAQ: PLCC), for example. PLCC had very large losses in 2008, followed by a string of money losing years since then. Despite the obviously large problems the company was facing, I still made nearly 80% on the stock after purchasing sometime in 2011. Take a look at the graph below:

Despite losing money since 2008, the stock remained buoyant somewhere below its NCAV and eventually popped up to NCAV on a bit of good news.

The rest of my money-losing net net stocks returned, on average, better results.

When You Should Avoid Money Losing NCAV Stocks

At the start of this article I told you that the question wouldn't yield a simple yes or no answer. While it is true that money-losing NCAV stocks can be great investments, I'm convinced that this isn't true for all of them.

When I look for NCAV stocks, I try to look for companies that have slipped into large business problems. My ideal candidate is a company that had been reasonably profitable but then stumbled big time. Companies that face large business problems typically start facing losses. Either the company has to write down the value of some of its assets or its operations are no longer profitable. In some cases the firm's legacy business is no longer viable so management has to reposition the company.

All of these situations can lead to losses but can still provide you with good opportunities for investment. The companies that I try to avoid, however, are the money-losing companies that have never earned a reasonable return in the past. All things being equal, I don't consider companies that have always lost money to be good net net stock investments. Benjamin Graham said in his 1951 edition of Security Analysis that, while the past is not a perfect predictor of future results, it is a decent approximation of how the company is likely to perform in the future. Companies that have chronically lost money, then, are companies that an investor can reasonably expect to lose money in the future.

A chronic money-losing company can make for a terrible investment. If it keeps losing money then eventually all the assets of the business will whither away and die. Management might need to keep issuing new shares to fund R&D projects that only have a thin hope of becoming profitable product offerings. A history of losses also decrease the likelihood of a 3rd party making a takeover offer for the entire firm since there has never been any profit-generating business there to begin with.

Obviously each situation needs to be examined individually. In some cases you may be justified in making an investment in the struggling firm. For example, if a new activist shareholder became majority owner then your chances of profiting by buying shares at a meaningful discount to NCAV would be much higher. Sometimes, when it comes to profitability, management just can't get it up and new talent has to be injected to have any hope of developing a profitable business.

Should You Really Avoid Money Losing NCAV Stocks?

Maybe. I have achieved great returns from net net stocks stocks of unprofitable companies but my picks represent a subset of money-losing firms. Still, taken as a whole, Oppenheimer's study shows that there is no real difference in the population returns of profitable versus unprofitable net net stocks. As an investor, if you choose to invest in unprofitable net net stocks, then I recommend sorting the chronic money-losers from the firms that have stumbled into large business problems. Doing so should boost your overall returns in a meaningful way.

Of course, you need to be able to find net net stocks to invest in before you can start selecting investment candidates. Net Net Hunter takes a lot of the work out of finding the best possible investment candidates in 5 international markets. Make NCAV stocks a big part of your investment strategy -- Click Here for more information on membership.

Not ready for membership? Make sure to get a free net net stock essential guide. Enter your email in the box below.