Your Ultimate Guide To Buying Net Tangible Assets

Download Your Essential Net Net Stock Guide for FREE. Click Here.

Why do so many exceptional value investors by cheap stocks relative to their Net Tangible Assets?

Most investors today are focused on buying big, growing, firms with a solid record of earnings. Recently Apple has been in the news and it's easy to see why. Despite any current problems the company may have, its products are hot, very profitable, and the company has experienced a lot of growth over the last 10 years. Its no wonder investors are drawn to great companies like these. They're exciting, and great conversation at cocktail parties.

But for every Apple in existence, there are a large number of duds - companies that burned brightly before suddenly fizzling out. While Microsoft's stock price has surged recently, despite possibly being the most successful tech company ever, its stock price languished since 2002… up a sickly 100% in 15 years. And even if investors catch a shooting star, there's no real way of knowing when to jump in or out of the stock. Could you really see the firm's exceptional rise coming back in the mid 2000s?

Exceptional value investors, like Warren Buffett, can capitalize on rare companies that are both priced inexpensively but also provide outstanding profitable long term growth due to a strong competitive advantage. Few others can do the same - even David Winters, the intelligent Buffetteer who runs the Wintergreen fund, has suffered weak performance trying to emulate his hero.

More and more intelligent investors are turning to deep value investing in order to achieve outstanding returns. Deep value investing is enormously profitable, avoids the need to cherrypick a handful of truly outstanding companies, and rests on exploiting systemic irrationality; but, it also requires a certain amount of self reflection to start.

Among the handful of exceptional deep value strategies in existence, investors with a long history of exceptional returns have turned to one strategy more than any other: low price to net tangible assets.

What Exactly Are Net Tangible Assets?

As the name implies, we're talking about assets that are tangible, but there's a specific definition we like to use here at Broken Leg Investing.

To arrive at net tangible assets we take the firm's shareholder equity value (or "book value") and then subtract any goodwill, intangible assets, or tax receivables that the company has. This results in a much more conservative assessment of the firm's "shareholder equity".

Shareholder Equity

- Goodwill

- Intangible Assets

- Tax Receivables

= Net Tangible Assets

The remaining assets are tangible in nature - you can touch, feel, lick, or smell them - with few exceptions. Goodwill and intangible assets, on the other hand, are non-physical.

Net tangible assets is also known as net tangible asset value (NTA) and we use the two terms almost interchangeably. There's a specific dollar value pegged on the firm's total net tangible assets, after all.

Why Exclude These Assets When Calculating Net Tangible Assets?

Don't the firm's intangible and non-physical assets have value?

Why exclude them from the net tangible assets calculation?

It's true that in a lot of cases intangible assets and goodwill have value, but their values are so uncertain that we can't state that as any sort of universal rule.

Goodwill arrises when one company buys another company and pays more for that company than its net assets are worth. Say, for example, that El Mexicana Ltd. was going to purchase Dos Tacos. Dos Tacos's net assets might be worth $100 million. If I pay $120 million for the company, though, I've just created $20 million of goodwill. I would record $100 million of Dos Tacos' net assets on El Mexicana's balance sheet and $20 million as goodwill.

The reason why I would pay an excess $20 million over Dos Tacos' net asset value is because I think there is some additional benefit worth at least $20 million that I would gain from purchasing the company. These assets are intangible in nature.

Warren Buffett loves intangible assets such as brands because these intangible assets are often what allows a company to earn fantastic returns. Coca-Cola's brand definitely has significant value and helps Coke earn well above average profits. Intangible assets can definitely have value, but valuing those intangible assets is very difficult. This is especially true when assessing deep value companies which are often troubled businesses.

The question we have to ask is whether I've overpaid for Dos Tacos or not. It's definitely possible that I have. Often management teams will look at a firm and mis-assess its intangible assets. They'll be too optimistic, paying too much to acquire a business, only to later realize that they were wrong in their judgement.

Intangible assets are also intangible in nature - they're things like customer relationships, contracts, etc. These can have value depending on the specific item in question but, again, the true value of these items is very uncertain and can vary wildly from their stated values on the balance sheet.

It pays to approach investing with conservatism since this ultimately reduces losses. The conservative approach to dealing with intangible assets and goodwill is to exclude them from the calculation altogether. This brings us closer to a conservative assessment of the company's shareholder equity.

The Off-Balance Sheet Liabilities Dilemma When Assessing Net Tangible Assets

The true-blue value investors among you will notice that I left something out of my net tangible assets calculation: off-balance sheet liabilities.

There's an ongoing argument in the world of deep value investing between those who want to take all liabilities into account, including off-balance sheet items, and those who want to stick to the balance sheet.

Actually, the dispute goes a lot deeper than that one specific question. The real argument is over where you should fall on a more general spectrum as a deep value investor. On one end of the spectrum are true Grahamites who want to place an exact value on every asset and liability associated with the company. By doing this, they hope to arrive at a very accurate assessment of real world value and expect this greater accuracy to yield better returns & reduced risk.

On the other side of the spectrum are those who I've dubbed contrarian value practitioners. These investors are pragmatists who are willing to follow stated balance sheet figures to find a prima facie valuation to hang their hat on. The belief is that items like "book value" or "earnings" are highly useful when it comes to real world investing and that digging deeper to arrive at marginally more accurate valuations does not boost returns and decrease risk enough to justify the added work. These folks stick closely to the 80/20 principle, that 80% of your results come from 20% of your work.

I fall somewhat closer to the contrarian value camp than I do the true-blue value camp. I'm very sympathetic to the idea that valuations based on financial statement figures have major real world value - and countless studies support this. In contrast, there's no real world evidence that I know of to suggest that a deeper dive into the financial statements produces higher average returns or reduced risk when running a diversified portfolio.

When it comes to assessing net tangible assets for our Ultra strategy, we base our valuation strictly on the firm's balance sheet. Net tangible asset value is not intended to be an estimate of liquidation value and we don't expect many if any of our firms to liquidate. Rather, it's a conservative assessment of the firm's historic cost of assets.

One of the reasons we're so comfortable with this approach to valuation is because the returns on offer are very good. Our own studies have shown returns in excess of 25% compounded annually from 1999 to 2017 for variants of our Ultra strategy. That's exceptional for any investor. The second reason we're comfortable with this approach is because we employ a long list of criteria when assessing each investment and this criteria boosts returns and decreases risk. But should we just use book value?

Do Net Tangible Assets Really Improve Returns Over "Book Value"?

Yes.

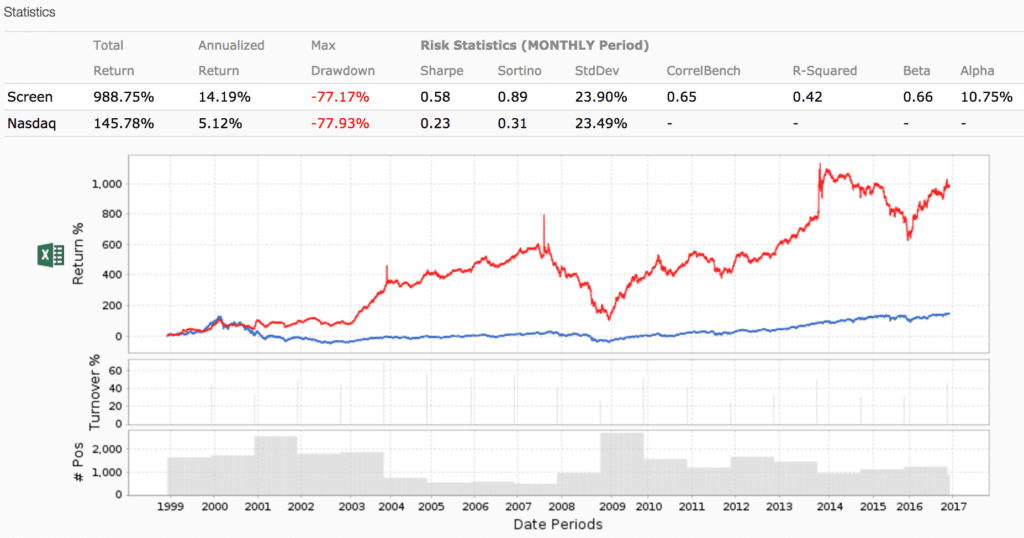

I just ran a simple backtest for both net tangible asset stocks and low price to book stocks. In the first test, I isolated all firms that had a market capitalization less than their book value. I included only those firms that had a 20 day average dollar volume greater than $2,000 to ensure that small investors could actually purchase the stocks. I also included a 2.5% "slippage" fee, or a 2.5% penalty when buying or selling a stock to more accurately reflect real world investing. This test accounts for survivorship and look ahead bias.

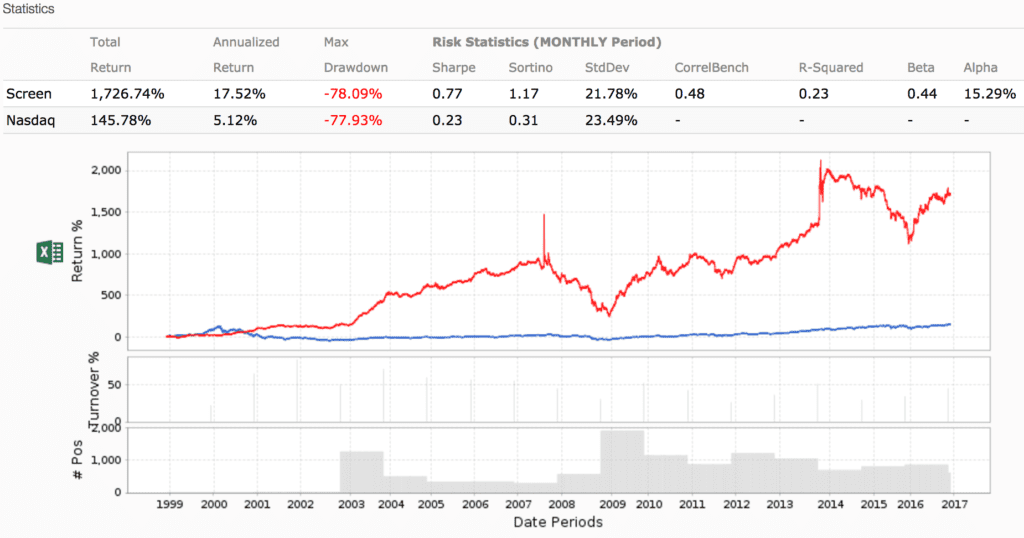

While it was a rocky 18 years, low price to book value stocks performed very well from 1999 to 2017. Investors buying baskets of low price to book value stocks and then re-balancing the portfolio every 12 months could have come close to achieving a 14% CAGR.

I ran the exact same test for low price to net tangible asset value stocks over the same period. In fact, I only changed the criteria from book value to net tangible assets, so everything was lined up exactly the same for a fair head-to-head comparison.

Firms trading below net tangible assets performed much better as a group over the time period. While the added 3.3% compound annual return doesn't sound like much, it produced a much larger retirement savings over the 18 year period.

$100 invested in each over 18 years would have become…

Low Price to Book Stocks… $1,089.70

Low Price to NTA Stocks… $1,828.15

Difference… -$738.45 …or -40.4%

Making the mistake of investing in low price to book value stocks rather than firms trading at a low price to net tangible assets meant LOSING $738.45 in additional profit. Put another way, your returns would have been 40.4% LESS than a low price to net tangible assets strategy.

You can scale that up to your portfolio's current size. Investing $100,000? You would have LOST $738,450 in ultimate savings.

Small bumps up in your CAGR over time produce VERY LARGE differences in eventual savings. This is one reason I started Net Net Hunter Membership. Investors should not have to pay large fees to mutual funds when their performance is so bad long term.

So, how do we recommend that investors leverage a low price to net tangible assets strategy?

Understanding The Low Price To Net Tangible Assets Framework

If there's one critical aspect of deep value investing that investors have to internalize its the fact that this sort of investing is based on a statistical anomaly and that has to shape your portfolio policy.

Don't yawn. Portfolio strategy is very important to your long term success as an investor. That's why I wrote an entire investment guide covering that topic.

This sort of investing is NOT like your typical Buffett buy and hold investing, it's a statistical strategy that relies on average group results. While it would be nice, it's also unrealistic to expect that each and every stock will work out. Instead, we expect the average results to be quite good in an average year.

You also have to keep in mind that, since this is a statistical strategy, diversification is a must. Buying a large number of low price to net tangible asset stocks will bring your portfolio much closer to the average return of net tangible asset value stocks generally. If you fail to adequately diversify, your portfolio returns are likely to very volatile and quite a bit more risky because you're much more likely to have a portfolio made up of stocks with extreme outcomes. When you diversify, the large number of stocks in your portfolio pull your returns towards the average return for net tangible assets stocks.

So, how many stocks is enough?

Above we looked at a pretty basic low price to net tangible assets stock strategy. It amounted to merely demanding a market capitalization less than a firm's net tangible assets and an average daily dollar volume of at least $2,000 USD. If you're aiming to replicate this strategy, then you should aim for around 30 stocks in your portfolio.

What if you don't want to buy and manage 30 different stocks?

Quite simply, you boost the quality of your holdings through well selected additional criteria. This is exactly what we do when we select stocks for our Ultra strategy.

How We Buy low Price To Net Tangible Asset Value Stocks

Is low price to net tangible assets the best value strategy?

We've taken an in-depth look at net tangible asset value stocks in this article. I've shown you how to calculate net tangible assets, why net tangible assets is a more conservative estimate of shareholder equity, and that this more conservative estimate produces higher returns resulting in nearly double the eventual savings over an 18 year period.

In fact, it's exceptional that a net tangible assets strategy can outperform a basic book value strategy to such an extent long term. The basic net tangible asset strategy above only produced a compound 3.3% edge over the basic book value strategy but nearly doubled the eventual savings. A small boost in yearly returns provides a massive jump in the amount of money you end up with.

So, is there a way to boost returns even higher?

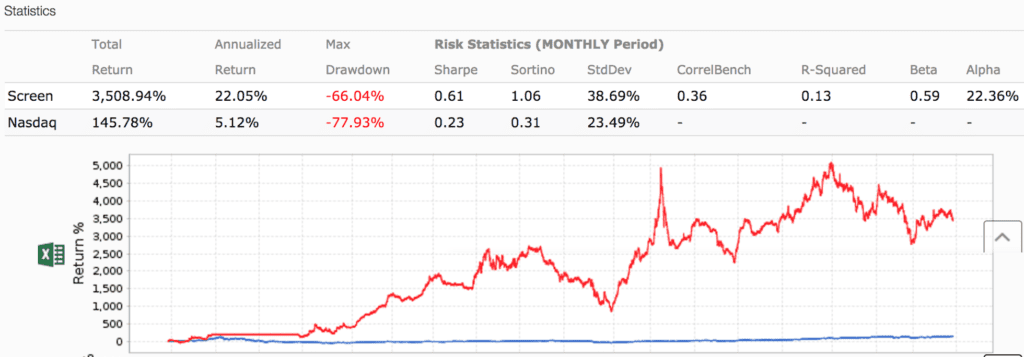

Yes, and this is exactly what we do with our Ultra strategy. "Ultra" is short for "ultra cheap price to net tangible assets" so it should be no secret that we aren't just picking stocks trading below net tangible assets - we want the cheapest net tangible asset stocks available. When selecting stocks for our portfolio, we demand a minimum 60% discount to net tangible assets.

This is a good start, but the defining criteria also calls for a company operating in the sweet spot in terms of market capitalization. It's no secret now that stocks of the smallest deep value companies produce the highest returns. The same is true for our Ultra stocks strategy. To focus on these firms, we demand a market capitalization between $1 and $100 million USD. Above $100 Million, returns really start to drop; while, below $1 million, firms can suffer due to inexperienced management and undeveloped business processes.

Finally, we also look for either share buybacks or insider buys in order to boost returns and decrease risk. Management who choose to buyback their own company's stock do so only when they do not expect that the company will need the cash to survive whatever crisis its currently going through. Buybacks also suggest that management is shareholder-focused and are aiming to increase the intrinsic value per share.

Insider purchases, or purchases by executives and directors, are similar. An insider will only buy a stock if he or she feels that its in his or her own best interest to do so. In other words, an insider will only buy because they expect to make money on the investment. Since insiders are in the best position to know what's on the horizon for the company, it makes sense to follow their lead.

So, our Ultra strategy's defining criteria are:

- 60% discount to net tangible assets or more

- Market cap between $1 and 100 million

- Share buybacks or insider buys

This is all well and good, but how does this strategy perform?

Exceptionally. Take a look:

Our basic Ultra strategy, our Ultra strategy that only employs the defining characteristics, produces a very solid 22% return. Keep in mind that our defining criteria above are only some of the criteria that we use in our scorecard. We expect to be able to bump this number up a bit, to 25% over the long term, with help from our additional ranking criteria . For more information, click here.

It's worth pointing out how enormous the advantage is for investors employing our basic criteria. We pointed out above when looking at our low price to net tangible assets backtest, with a 17.5% CAGR, that an investor who invested $100,000 would have ended up with $1,828,000 over 18 years.

Low Price to NTA Stocks… $1,828,000 over 18 years.

This was $738,450 MORE than investing in a simple low price to book value strategy, even though the net tangible assets portfolio edged out the low price to book value strategy by 3.3%. But, how much could a deep value investor have earned if they invested in our Ultra stocks?

Well, $100,000 invested at 22.05% for 18 years would grow to $3,611,000.

Ultra stocks… $3,611,000 over 18 years.

It really pays to pick the best strategies when investing for the long term. Here, the additional 4.5% would have DOUBLED your eventual savings over the end of the 18 year period. Put another way, investors who failed to take advantage of our Ultra strategy would have LOST $1,783,000 in retirement savings.

Net tangible asset value stocks are one of the best strategies available for small investors. By concentrating your retirement funds on the best possible strategies, investors can maximize their long term savings, accumulating far more to retire on, or even retire early.

Get the free net net stock essential guide. No obligation, no risk, no spam, just our free net net stock essential guide you can use. Enter your email address in the box below right now!

Article image (Creative Commons) by superscheeli, edited by Net Net Hunter.