NCAV Case Study: How To Select The Best Net Nets

Evan has used lessons from Warren Buffett, Benjamin Graham, plus other top investors and academic studies to craft a high performance net net stock checklist. Download our net net checklist right now for free. Click Here.

There are a lot of net net stocks out there, but do you know which you should concentrate on? With over 500 statistical NCAV (net current asset value) stocks on our Net Net Hunter Raw Screen, how are you supposed to narrow down the pool of candidates to a manageable size?

And how do you select stocks for your portfolio once you have a manageable group to work with?

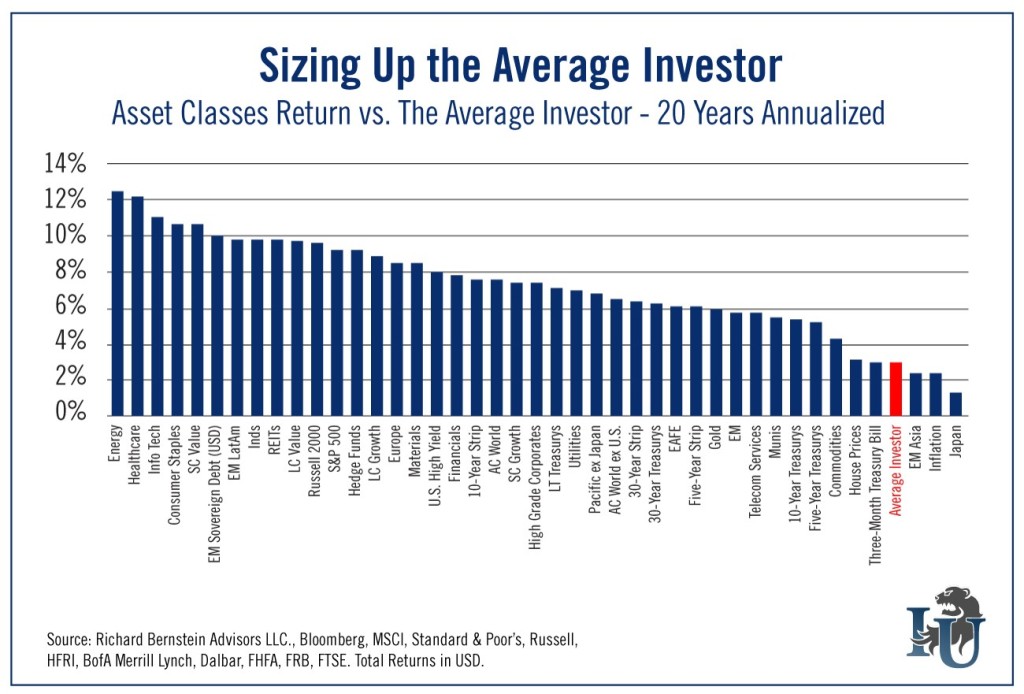

A lot of investors make the mistake of thinking that any net net stock will do when running a net net stock strategy. This error causes a lot of investors to lose money each year or, even worse, abandon the strategy altogether thinking that it doesn't work. That outcome is tragic considering how well a decently executed net net stock portfolio will perform over the long run. Despite all the evidence, many retail investors are pros at self-sabotaging and end up with miserable returns over the course of their life.

A Primer on NCAV Stocks

What are NCAV stocks?

NCAV stocks are essentially low price to book value stocks but where long term assets have been excluded from the calculation. This provides a very conservative assessment of liquidation value.

NCAV is short for "net current asset value," and was brought to fame by the Dean of Wall Street himself, Ben Graham. Graham found that a firm's NCAV was a good approximation of its real world liquidation value. Even better, buying firms below their NCAV produced outstanding portfolio returns for investors over time, better than any other value investing strategy.

Calculating NCAV is very straight forward. A firm's NCAV is basically its Book Value, excluding Long Term Assets. There are some other small adjustments you should make -- such as making sure to deduct the value of preferred shares and subtracting off Balance Sheet liabilities to get to a true assessment of liquidation value. For a better understanding of NCAV stocks, make sure to read my essential guide to net net stocks.

A NCAV Investment Checklist?

Checklists have been tremendously valuable in all sorts of industries for reducing or eliminating human error. Pilots, for example, go through a list of things they need to check on an airplane before takeoff in order to reduce any factors that could lead to a devastating crash. They don't leave something so important to chance, or memory.

More recently, investors such as Monish Pabrai have incorporated checklists into their own investment process to make sure they don't leave out any critical pieces of information when researching a stock. Warren Buffett and Charlie Munger are no different -- though they call their checklist items "filters".

While it's not possible to eliminate all human error, you can go a long way towards reducing your own mistakes by putting together a scorecard to use when assessing potential investments. That's what I did, and the results have been fantastic. Click Here to look at my brokerage statement for the first 10 months of 2014. Make sure to also check out the returns of my Hunter Deep Value Fund.

Building My NCAV Scorecard

I've spent a considerable amount of time combing through Benjamin Graham's books, Warren Buffett's partnership letters, and a number of different scientific studies that examined NCAV stocks. In the process, I've kept notes on the investment tactics that produce the highest possible returns using this strategy.

I've put those best practices together into an investment checklist that I've found invaluable when selecting NCAV stocks. Given my NCAV portfolio's exceptional returns over the last 3 years, I've decided to update this checklist for 2014.

The checklist runs through critical elements that must be in place before I'll even consider a stock before covering other key factors important in the selection process and eventually moving on to some of the qualitative facts that I look for. This entire body of criteria comes into play when I look at net net stocks to buy or when I publish research analysis for those who signed up for yearly Net Net Hunter membership.

It's important to remember that this checklist serves as a great first run through for any net net stock that you're assessing but it doesn't cover some of the qualitative aspects that separate the promising NCAV stocks from the ones that will see stratospheric returns. I don't think any checklist can successfully cover those soft facts because recognizing these types of patterns takes significant experience in business and investing.

My NCAV Scorecard

Core Criteria

This is the first set of criteria that I use. To me, this set of 7 criteria is black and white and can lead me to immediately exclude a company from being an investment candidate.

Not Chinese - I won't buy a net net stock of a company that is based in China or has major operations in China. Basically, I'm trying to avoid reverse takeover scams. While there are probably good Chinese net net stocks I just feel it's better to avoid this group as a whole.

Low Price-to-NCAV - Less than 50%. The reality is that the the smaller the price to NCAV the better the returns will be as an average. The difference between a stock trading at 40% of it's NCAV and one trading at 60% of its NCAV is striking. While the company trading at 60% of its NCAV only has to rise 66% to be fully valued on a net current asset value basis, the company trading at 40% needs to rise 125% to reach fair value. On top of that, the higher priced NCAV stock has a greater likelihood of falling further in price while the cheaper priced company can provide great returns even if it doesn't reach full net current asset value.

Low Debt-to-Equity - The same reasoning works for debt-to-equity levels. If the company has too much debt, making for the spread between total liabilities and current assets too thin, then the company's NCAV can easily be wiped out. Having a low debt-to-equity ratio means having a large margin of safety. I won't invest in a company that has a debt-to-equity ratio of over 25%.

You should keep in mind that a key part of calculating a firm's NCAV is taking into account any preferred shares that are part of the company's capital structure, and the off balance sheet liabilities that the company is on the hook for. I don't screen out companies that have unfunded pensions -- which are a common source of off balance sheet liabilities -- but I do make sure to include the unfunded pension in the company's total liabilities section. You should do the same since this is an obligation the company has made which amounts to a debt. Unfortunately, unfunded pensions aren't included as part of the balance sheet so you have to dig for the information.

Adequate Past Earnings or Catalyst - I want my companies to have shown an adequate record of earnings in the past. While I don't spend a lot of time measuring net profit margins and comparing those margins to the company's peers, a history of low profitability tends to produce perennial NCAV stocks, stocks that always seem to trade below their net current asset value. Barring suitable profitability, I'd like to see some obvious catalyst on the horizon that would lead to either improved business results or a meaningful rise in the stock price. For example, if management suddenly put the company up for sale then I would expect that the company could be sold for at least the value of its net current assets.

An adequate past record also means a fairly stable past record. How stable is stable? Tough to say. This is a qualitative figure but I can recognize a company with an unstable past record of earnings as I see it.

Past Price Above NCAV - While its true that the past price of a company is not a good predictor of the future price of the stock it can serve as a warning sign. To me, when a company's stock has traded below NCAV for years it's a big red flag. Typically, NCAV stocks tend to rise within 3 years because a firm buys the company, the company liquidates, or the company is able to solve the problem that pushed it deep below NCAV in the first place. If the stock has traded below NCAV for a good number of years than it's a sign that management is having a tough time addressing the business issues they were facing and that their either unwilling or unable to sell the firm. Sometimes parasitic management is just complacent and content to suck back fat salaries while the business does nothing for investors.

Existing Operations or Liquidation - Another great way to burn your money is by buying companies that don't have existing operations. This includes things like legal entities (corporations, LLCs, etc) sitting on a bank account but not much more, with only faint promises of future business operations or, more commonly, pharmaceutical research companies which always seem to burn through their working capital without much to show for it. In cases like these, you may never see your stock rise up to its NCAV. You could wait forever only to disappoint your grandchildren by leaving them the deadbeat stock in your will. An obvious exception to this is buying a pile of assets that are going to be liquidated.

Not Selling Shares - What could be worse than a company that's selling its own shares while they trade below NCAV? When a company buys its own stock while the stock is undervalued the excess value accrues to the remaining shareholders but when a company sells shares below fair value then it destroys value for current shareholders. Given that obvious fact, management sends investors a strong signal about the health of the company or their own attitude towards shareholder value when they sell shares below fair value. Either case is bad -- but it can be difficult to know the actual reason management has chosen to destroy value. Assume the worst to protect your downside.

Key Quantitative Criteria

Some of these criteria below are not make-or-break items but they do play a role in helping me decide which stocks to invest in. If two NCAV investments are pitted against each other than these criteria can come into play to help make a decision. As well, some of these criteria well cause me to strongly lean away from a company but not exclude it altogether.

Large Current Ratio - As large as possible. I want as large of a gap between the current assets and the current liabilities of a company. Having a large gap serves as a margin of safety of sorts. If the company has a couple current assets go sour, asset backed mortgages or bonds of junior mining companies for example, the large spread between current assets and current liabilities acts as a buffer ensuring that the NCAV of the company isn't significantly impaired.

Small Market Cap - I try my hardest to invest in tiny companies. The profits an investor can make from a handful of tiny companies dwarfs the profits he or she can make from a portfolio of small or mid cap companies. When it comes to size, I like companies smaller than $50 million USD. Yes, I still find these NCAV stocks easy to buy -- and you likely will, too.

Low Price-to-Net-Cash - I consider price-to-net-cash a bit of a bonus. The main thing that price-to-net-cash does is insure the quality of the assets. Think about this for a second: which is cheaper, a million dollar bond I sell you at $50 thousand or a million dollar house I sell you at $50 thousand? A lot of people automatically assume that a company which is trading at a low price-to-cash figure is cheaper than one trading at a high price-to-cash figure. There's much more that comes into play, though. Essentially, in the example above, both investments were just as cheap. A key advantage that the bond had, though, is that there is a much more liquid market for bonds than there is for houses. Because of that you can be more certain of the value of the bond. There is much less risk when it comes to value assessment. The house, ultimately, might get offers that don't even come close to $1 million. Since no two houses are exactly the same, people may assess the value of the house differently. There is much more uncertainty in terms of real value. Similarly, when it comes to receivables and inventory, investors only have a best guess at what they're worth while cash has a bulletproof value.

Key Qualitative Criteria

Financial/regulated/ADR/Real Estate/closed fund - I generally try to stay away from any financial, real estate, or regulated businesses, as well as ADRs, and closed funds. I basically only try to invest in industrials or retail companies, and other similar firms. I have bent this rule in the past when it comes to financial companies but it's not something I will be trying to do in the future. It can lead to a lot of problems if an investor is not careful. Just look at the balance sheet of a bank, for example. Banks operate with a slim sliver of equity compared to the size of its assets and liabilities. If the bank breaths wrong then the equity can be completely wiped out. Peter Lynch said that the best banks to invest in were the boring predictable ones since they were the safest... but not many of those seem to fall into the net net stock universe.

Regulated companies may need government approval for turnaround plans, buyouts, etc, and all of this may make a company much less appealing to firms who would otherwise be interested in purchasing it.

I don't know much about ADRs. I could learn, but there are other things I would like to do with my time - like research the suitable companies I find in Canadian, British, and Australian markets. The same goes for real estate firms and closed funds.

Company is Buying Back Stock - Every time a net net company buys it's own stock it increases the value of my own holdings. That's because for every dollar a company spends on it's stock, as a net net company, it takes back a disproportionately large share of its net net value which is then shared by the remaining shareholders. When a company buys back its own stock it also makes a strong vote of confidence in its own future.

Insider Ownership - Insiders who own stock act as owners rather than just employees. They have a chunk of their own net worth on the line. This means they're well motivated to see the company recover and their interests are also aligned with my own.

Major/Minor Insider Buys Vs. Sells - My ideal NCAV stock has a large number of insiders who are busy buying even more stock. Insiders can sell shares for many different reasons but they only buy stock for one reason -- they see a significant opportunity to earn capital gains. Insiders have the best understanding of how the company is currently doing. If you see insiders buying the company's stock during a time of crisis then it's a good sign that the company will survive the crisis and see better days. If insiders are gobbling up buckets of stock than I immediately get on the phone with my broker.

Burn Rate Low or Positive - I've dubbed one of my key considerations "burn rate". Burn rate is the percentage change in NCAV from year to year, or quarter to quarter. I don't want to invest in a company whose net current asset value is rapidly eroding. If that's happening, then so is my profit potential. Of course, I will overlook either of these if there is a large enough margin of safety in terms of overall NCAV-to-revenue or profits.... and if the company is trading at quite a low price.

Catalyst - A catalyst is something that will happen in the future which will spark a return to fair value. For example, NCAV stock GTSI had been punished by the government, preventing it from bidding on government contracts for ~ 3 years. It was trading far below net net value. It was also a great net net stock because eventually the ban would be lifted allowing the company to return to former profitability. Catalysts can add enormous value, and your skill in spotting them really comes down to your own business experience. Sometimes a company will be actively looking for a buyer to sell the entire company to, while at other times it could launch a website in a rapidly growing new niche, such as electric dirt bikes.

Insider Pay - I don't like it when managers of tiny companies have large salaries relative to assets or revenue. I specifically gage insider salaries relative to assets or revenue since these two metrics are a lot more stable than a company's market capitalization is. Net earnings are even less stable. When a company's market cap slips down below its NCAV, the market cap ends up being substantially smaller than it once was. When management solves the business problems the company is facing, market cap will rebound.

But What About....

Notice in my list that I didn't include profitability? There is a very good reason for this. Profitability doesn't matter. I'll have more on that later but if you want to take a look at other ways of assessing a net net stock then make sure you join our community.

One of the biggest issues with net net investing is finding investment candidates. If that's you, sign up to receive a free net net stock checklist right now. Click Here