Cheap Gold Stocks

During times of global uncertainty, investors fearful about the future often move their assets from equities to gold stocks, which causes the price to rise. While investing in a commodity that is rising in price may not be a great move for some people, there are certain situations in gold that could reap rewards for the prudent investor.

Gold Investing Is Useless… but What About Cheap Gold Stocks??

Should You Buy Gold or Not? Why?

We can predict that the financial media will always capitalize on current events to try to make sales. For example, market turmoil - caused by knee-jerk reactions to headline-grabbing global events - often brings out the gold promoters.

In fact, you may be watching the price of gold rise and become worried that you missed out on cheap gold stocks.

But you shouldn’t worry. As with all markets, there is opportunity if you know where to look. And because of the cyclical nature of the mining industry, there are always cheap gold stocks available around the world.

Warren Buffett on Gold Investing: It Is Not Worth It

Warren Buffett’s 2011 annual letter to shareholders includes a lengthy discussion on gold, which was then at an all-time high of around $1,920 per ounce. In that letter, Buffett placed gold in the category of assets which “...will never produce anything…” with buyers of gold simply buying because they hope that someone in the future will pay them more for it.

Prior to that, in 2009, Buffett commented that “I have no views as to where [gold] will be [in the next five years], but the one thing I can tell you is it won’t do anything between now and then except look at you.”

And so, value investors around the world who read Buffett’s annual letters as gospel became of the opinion that investing in gold was not a good idea. Many investors also took his statement to mean that investing in any company which touches the gold industry is a bad idea. Now, Mr. Buffett is always very specific and direct in his letters, but this point is often missed by many investors.

Buffett Buys Gold…...Barrick Corp A Cheap Gold Stock

Of course, Buffett’s strong and historical stance against gold was big financial news in 2020 when it was revealed that Berkshire Hathaway purchased around $563 Million of stock in gold miner Barrick Gold (Ticker: GOLD). The news was “earth-shaking in the gold market”.

Not surprisingly, earth-shaking news on current events tends to be overblown, and a second look at the situation uncovers a more rational story than Buffett suddenly reversing long-held views. Did Buffett really reverse course and buy cheap gold stocks?

First, the position taken by Berkshire Hathaway is a very small position in the overall scheme of Berkshire’s holdings - about 0.3% at the time of purchase. Second (and a crucial piece ignored by gold marketers), Berkshire bought stock in a company which produces gold.

Not only does Barrick produce gold, but it produces free cash flow and a dividend as well.

Barrick was an attractive stock. It also happened to be a cheap gold stock. It was trading at less than 11 times earning over the previous 12 months, and its operating earnings have been consistently positive - even when gold itself was performing poorly.

Additionally, Barrick pays a growing dividend. So, even though the company produces gold, it was also attractive as an investment because it produces something, unlike an “investment” in gold itself.

Gold Investing vs Net Net Investing

Gold returns grab headlines for awhile and then mysteriously disappear. Over a 10-year period, gold is sitting at -4.85%, while the S&P 500 is at 137.84%, including dividends. [Source: Longtermtrends.net].

So are cheap gold stocks really a great investment?

How does investing in gold fare against investing in net net stocks? Well, considering that a conservative return over, say, a 10-year period for net net stocks is a 20% annualized average return, investing in net net stocks is clearly significantly better.

Because I’ve never purchased gold as an investment, I don’t have any horror stories to discuss first-hand, but I imagine that one would go like this: Gold prices hit an all-time high, investor reads an article that “they must go higher” and so he purchases an ETF tied to gold, and then prices crash. He pulls his money out, swearing off investing in gold again, and that’s it.

That’s really all that happens - it’s not very complex - but it is very common.

Why Gold Prices Are at a Multiyear High

So why are gold prices at a multiyear high? There are a few reasons, but nearly all have to do with the future.

When there is uncertainty in the world - such as tensions rising between the U.S. and Iran, a global pandemic, calls for a recession in the media - some investors tend to react by moving their money from equities to gold.

Cyclicality of Gold - Wait for the Crash but Buy Cheap Gold Stocks?

Is it better to wait for gold prices to crash or to buy cheap gold stocks? That really depends on your future outlook.

However, since you likely cannot predict the future, and therefore cannot predict the future price of gold, you might be better off buying cheap stocks - whether they’re gold producers or not.

Gold Mining Stocks - Buy Cheap Assets

Given the returns, our preferred strategy is Graham’s classic net net approach. Applying the net net strategy to gold stocks is no different than applying the strategy to companies that produce other types of widgets. Finding cheap gold stocks is simply a matter of screening for the companies with current assets greater than their total assets, or trading at a discount to NCAV.

These firms are rare, but they do surface. The best practice is to avoid exploration companies that tend to burn through cash, acting like a tumor on your portfolio. On the other hand, sometimes you can find a dirt cheap gold stock relative to net tangible asset value, which makes for another promising buy.

Miners Tend to Outperform the Rising Gold Price

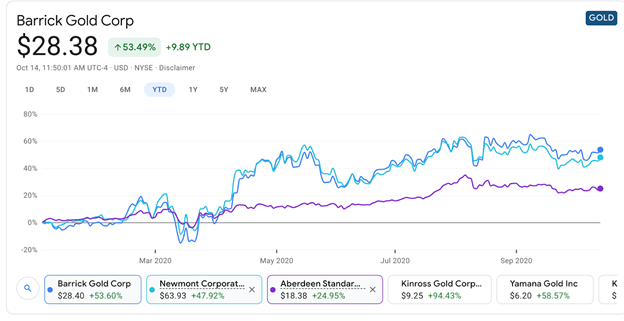

Gold miners tend to outperform the rising gold price, as shown by this graph from Google Finance:

If you knew when gold was going to rise, buying up cheap gold mining stocks would be better than buying gold bars. There’s just more leverage attached to these firms.

Gold Stock Investing Risks

People who buy mining stocks are hoping for capital appreciation whereas people who buy gold bullion are doing so mainly to store their wealth in a manner that keeps up with inflation. This is probably only a good idea if hyper-conservative valuation methods are used.

Of course, there are risks. For example, you could be wrong about the direction of gold prices, you could buy stock in a company with too much debt, or the company could be overly optimistic about the value of the gold that it hasn’t mined yet and is still in the ground.

[You still need to explain the risks. I would suggest 2 or 3 of them: Being wrong about the direction of gold, larger downside than just buying gold due to leverage, assumed asset quality in the ground might turn out to be lower than expected which could curtail production.]

Net Net Gold Mining Stocks?

What about those net net gold mining stocks I mentioned earlier? Are there any available today?

There might be.

To screen for these stocks, remember what net net means. First, under a “Quick NCAV” approach, you’ll want to look for gold miners that have Current Assets greater than Total Liabilities, less the value of Preferred Shares.

The formula is:

“Quick NCAV” Net Current Asset Value = Current Assets - [Total Liabilities + Preferred Share Value]

If you’ve identified gold miner stocks that fit this criteria, then you can do a deeper dive into them by looking at their off balance sheet items, such as pension plans, legal penalties, operating leases, and other items. With this approach, you’re looking at the whole company to determine whether it is a good investing opportunity. If you’ve found a cheap gold stock, it’s always worth a deeper look!

The Bottom Line for Cheap Gold Stocks

So are stocks in gold or gold mining companies worth the hype? If by cheap gold shares you mean cheap gold mining stocks, then possibly. Gold equities for bullion are speculative in nature, and, as discussed above, gold bullion on its own does not actually produce anything.

As Buffett said, it just sits there and stares at you.

Inexpensive shares in gold miners, however, trading below NCAV that are net nets could definitely be an enticing opportunity. As we saw with Barrett Gold, above, some of them could even make money while gold bullion prices are low, which is a great quality to have in a gold miner company.

Benjamin Graham, the godfather of value investing (and net net investing), has a few thoughts on gold:

“The standard policy of people all over the world who mistrust their currency has been to buy and hold gold…But during all this time the holder of gold has received no income return on his capital, and instead has incurred some annual expense for storage.”

If that wasn’t bad enough, he also mentioned that...

“The near-complete failure of gold to protect against a loss in the purchasing power of the dollar must cast grave doubt on the stability of the ordinary investor to protect himself against inflation by putting his money in ‘things’.”

Gold prices will be all over the news when investors fear the future. But, buying stocks or ETFs of physical gold is speculative in nature, because you cannot predict the future of gold prices. Buying gold miners or other cheap gold stocks, on the other hand, which produce free cash flow and dividends and are trading below NCAV or another robust net asset value approach may produce some exceptional returns.

Start putting together your high quality, high potential, net net stock strategy. Click to get free net net stock checklist.

Get full access to our VIP Newsletter right now, for FREE. Click Here.

Article image (Creative Commons) by Pea Chesh, edited by Net Net Hunter.