Japanese Net Nets: Fantastic or Foolish?

Investors should be forgiven for feeling weary of investing in Japanese net nets.

Over the past 25 years, Japanese equity valuations have been viciously attacked by bears, eroding their value roughly 80% from their 1989 high. Even today, with word spreading about the tremendous bottom up value investing opportunities available in Japan, investors face some seemingly insurmountable hurdles.

For one, there’s a serious lack of English language financial information. If you’re intent on doing in depth research on interesting small or microcap stocks, you’re faced trying to navigate a mountain of Japanese language financial reports.

Add to the problem rumours that foreign stocks are often priced differently from American stocks (or even those in the UK or Canada), as well as an assumed weak tendency of foreign stocks to revert back to intrinsic value, and it’s not hard to see why investors would want to stay clear of Japanese net nets.

So should you spend any time looking into Japanese net net stocks, or should you just stay clear of them entirely?

Why should I invest in Japanese net nets?

You should invest in Japanese net-nets because the returns on offer are great. Japanese net nets handily beat the market over the long term. More on that ahead.

When it comes to investing, I’m a big fan of coming to data-driven judgements based on solid statistics. As those who signed up for the free net net stock checklist already know, that’s what led me to become a net net stock investor in the first place.

The returns of NCAV stocks are fantastic. When it comes to classic value investing, there’s really nothing better. In academic studies, net net stocks have been shown to yield the highest return of every available classic Benjamin Graham styled investment strategy. The record of performance goes back at least until the 1920s, thanks to Graham’s original research. Returns typically show a 10-20% excess return over the market, which translates to roughly a 20 to 30% annual return over the long term.

Graham’s NCAV strategy has also been successfully employed in practice, by the likes of Warren Buffett, Seth Klarman, Walter Schloss, Tweedy Browne, and legendary Canadian value investor Peter Cundill. Suffice it to say, you're in good company if you plan to adopt it.

Here’s Why You Should Even Start Considering Japanese Net Nets

Until recently, all of the studies available on net net stocks have looked at NCAV stocks in the United States. It’s pretty obvious to see why – the USA has the largest equity market in the world by far.

Since people aren’t generally in the habit of giving something away for nothing, it takes a massive number of publicly traded companies, and some pretty serious business problems, for a significant number of firms to trade down below their net current asset value.

America has the size, and there’s no shortage of business problems within its borders, so it shouldn’t be surprising that investors have found most of their net net stocks on US exchanges.

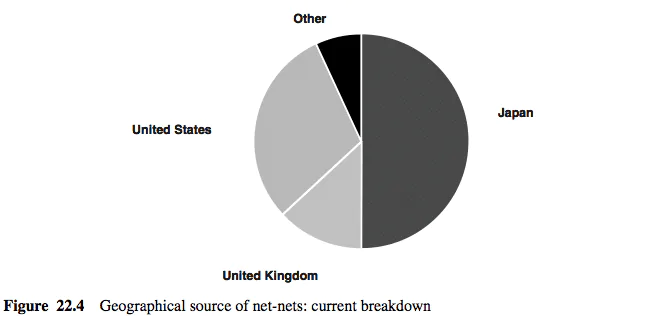

But with 3674 stocks trading on Japanese exchanges as of 2010, the monolithic drop in the Japanese markets since 1989 have opened up an ocean of opportunities. Just look at the breakdown of net nets by geography back in 2008 (pictured above). As it stands today, the vast majority of available net net stocks still trade in Japan – and there are some seriously interesting Japanese net nets to look at.

So is it worth diving into Japan to sift through the cigar butts in order to build a portfolio?

James Montier’s Take on Japanese Net Nets

In 2008, James Montier came out with a research paper titled, “Net-Nets: Outdated or Outstanding?”. In it, he surveyed the investment situation relative to Graham’s net nets on a global basis. What he found was that, of the 175 NCAV stocks available globally in 2008, over half were located in Japan. Following that lead, he took a look at what would happen if an investor put together a portfolio of Japanese net net stocks from 1985 to 2007.

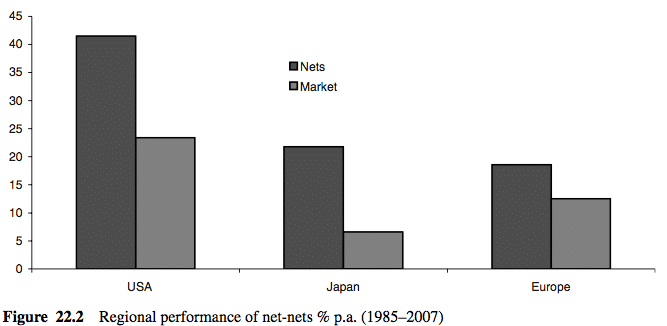

As it turned out, the result of investing in Japanese net nets from 1985 to 2007 was fantastic. While the Japanese stocks as a whole provided investors with a compound annual growth rate of just 5%, Japanese net nets decimated the index with an excess return over the market of 15% per year, coming in at a CAGR of 20% for the period. Not bad!

By comparison, while US net nets performed better overall, they also benefited from a fantastic tailwind. Yet, despite the great investing environment from 1985 to 2007, American net current asset value stocks merely doubled the market return, while Japanese NCAV stocks beat the Japanese index by 200%!

So much for the objection that net net stocks in Japan may not revert back to intrinsic value as readily.

Are Japanese Stocks Actually Undervalued?

Yes, Japanese companies are significantly undervalued as a group, especially when compared to other advanced markets. The entire market has a price to book value of just over 1x, for example, and firms are bloated with cash.

Some value investors would argue that the low ROE of these firms justify the price to book of 1x or less, but this is putting the cart before the horse, as many firms have low ROE figures because of the excess cash and securities on their books.

It's not just Japanese net nets (though this pool of companies is the obvious place to look) but many other firms are trading below net tangible assets with solid dividends and are actually growing. If you're a classic Graham investor, however, net nets are the best performing Japanese stocks.

Why are Japanese Stocks Cheap? Why So Many Net Nets?

Japan has a lot of cheap net net stocks because, as mentioned, the Japanese markets have fallen considerably since 1989.

But, Japan also has a lot of cheap stocks due to their unique business culture, focusing on stakeholders rather than shareholders. They favour looking after employees and the community over making a profit, for example. That leads management to do things such as horde cash and pretty much ignore the stock price so it may trade under net net value for years (decades?).

But times are changing. Japanese regulators have moved to change that business culture by pressuring Japanese companies to get their stock prices up to at least book value, or face penalties. They've also started to create a supportive environment for activist investors - historically taboo in Japan. Both of these will cause Japanese net nets to perform very well over the next few years as companies scramble to close the price to value spread.

So, Can You Actually Invest In Japanese Net Nets?

Yes, you can actually invest in Japanese net nets but you do need a stock broker that offers international coverage, as discussed above.

Investors have the perceived notion that it’s nearly impossible to invest outside their home country. This is nothing but a limiting belief that holds a lot of investors back. Whether language barrier, worry over data, concerns over stock brokers... there's always an excuse.

But buying a Japanese net net is as simple as buying an American net net once you have your broker sorted out. On that note, there are a number of different US brokers to look at if you want to invest internationally, such as Interactive Brokers, Ameritrade, Schwab, etc. You just have to look.

How to Invest in Japanese Stocks

Buying a Japanese net net is as simple as identifying the company you'd like to buy, then punching in the stock ticker, number of shares, and desired transaction price into your broker's trading platform and clicking submit button.

There are a couple of small things to keep in mind, though. Japanese stocks trade in blocks of shares, typically 100 or 1000 shares per trade. You can then place an order for 200, 300, or 30,000 shares. They just have to be a multiple of 100 or 1000, and that depends on the company.

Japanese stock symbols are also written in numbers, not letters. So, you'll have to input a number when buying - but most people can tell the difference between a number and a letter, so probably not a big deal.

Japanese Stocks And Language Barrier

But of course, a lot of people would object to buying Japanese net net stocks due to the language issue. They would look at Japan as a potentially great place to invest… so long as you’re a Japanese national or fluent in Japanese.

What these people fail to take into consideration is what I’ve already discussed with you, however: these were the CAGR returns of Japanese net nets as a group, not a pool of hand-selected stocks. In other words, all an investor would have had to do was invest in the bulk of Japanese net nets to approximate those returns.

When faced with ignorance, diversification is your friend.

It is, obviously, not quite viable to invest in all of the net nets available in Japan. Doing so would add a considerable amount of work to your investment strategy, and you’d be paying a lot more in trading costs. To limit both time and money you would have to limit the pool of candidates, likely by trying to pick the better opportunities – but how?

When selecting net net stocks for my own portfolio, I’m a fan of just doing what’s shown to work. I like simple, proven, time-tested, rational, approaches to investing. This is why I spent a considerable amount of time putting together Net Net Hunter’s Investment Scorecard. Utilizing it means eliminating firms that show a disproportionate amount of risk while embracing stocks that have a greater chance of showing significant gains. It’s really two sides of the same coin – a lot of the tactics you can use to reduce risk also boost portfolio returns.

One thing I always look for when picking Japanese net nets is the company’s total interest bearing debt to equity ratio. This is just the simple long-term debt to equity ratio found in a lot of investment books. While it may not be true in all cases, it's generally true that firms that don’t have debt can’t go bankrupt. By eliminating firms with a debt to equity ratio of over 25%, you cut down on the number of firms that get into serious financial problems leading to bankruptcy, saving roughly 5% of your portfolio from suffering a devastating loss. You also end up with a portfolio of firms that are more desirable as takeover candidates.

I also like to buy firms that are either increasing their dividends, or buying back stock. Both of these are strong positive signs that the company is not in serious, terminal, trouble. Share buybacks also increase your margin of safety because shares bought back when trading below NCAV increase the NCAV per share for the remaining shareholders. Both dividend increases and share buybacks also hint that management thinks the firm is in good financial shape and is highly likely to see brighter days in the future.

They also serve as a catalyst for price appreciation. Increasing dividends and share buybacks are sought after by a lot of investors, so when these behaviours are seen in the market, other investors start to make purchases which drives the stock price up.

What About Data and Your Ability to Trade Japanese Net Nets?

Admittedly, data can be tricky to find.

Net Net Hunter provides members with both a raw list of net net stocks and a hand screened net net stock Shortlist comprised of the best NCAV stocks in Japan, as well as lists for the USA, the UK, Europe, Canada, Australia, and Hong Kong. The stock Shortlists have been compiled to filter out unbuyable and extremely low quality net nets. I use the list myself to select stocks for my own portfolio.

A Net Net Hunter membership is probably your best bet for finding suitable net nets in any of these countries.

"Our experience with this type of investment selection – on a diversified basis – was uniformly good ... It can be affirmed without hesitation that it constitutes a safe and profitable method for determining and taking advantage of undervalued situations." - Ben Graham

But what about taxes? Well, to be perfectly honest with you, that’s why God made accountants. I have never done my own taxes—and never will!—when there are skilled accountants who are itching to do them for me for under $100. Let them deal with the tax complications. If you still have concerns, sit down with one or two of them to get an understanding of how investing internationally may affect your taxation.

Cheap Japanese Stocks: Are They Worth It?

Cheap Japanese stocks are definitely worth the small hassle when it comes to trading blocks, stock symbols, and the language barrier. The returns on offer from Japanese net nets rival those in the USA, and there are many more Cheap Japanese net net stocks to choose from.

Cheap Japanese stocks are also worth the additional work needed to turn up great buy candidates. But, it would be a mistake for you to do it on your own. If you could get a Japanese net-net stock list, you would still have to sort through it to filter for basic quality and buyability. That would take you about 15 hours worth of work before you even start to research the Japanese net-nets you like.

That's why I started Net Net Hunter. Every month we take most of the work out of finding and filtering Japanese net-net stock lists to arrive at a condensed group of the best Japanese net nets to research. We also have dozens of members who search for net net gems in Japan and share what they find on our members forum. This saves members a lot of time and effort and ultimately ensures that our members find the best opportunities available in Japan and don't spend all of their free time doing so.

The amount of work it would take you to turn up high quality Japanese net nets each and every year would ultimately mean you'd end up abandoning the strategy and opting for an investment approach with much lower returns.

Take most of the work out of finding high quality Japanese net nets (and net nets from other developed countries). Click here to read about Net Net Hunter membership: Explore Net Net Hunter Membership.

The returns on offer through Benjamin Graham’s best performing strategy are well worth it. How many years can you afford to miss out on 20-30% average annual returns?

Benjamin Graham's Japanese Dream

Ben Graham’s net net stocks are fantastic no matter where you want to invest. Again and again they’ve proven to be one of the top investment strategies open to individual investors. Japanese net net stocks specifically have done exceptionally well, providing outstanding returns for classic Ben Graham investors who venture into other friendly first world markets.

As Ben Graham wrote, "Our experience with this type of investment selection – on a diversified basis – was uniformly good ... It can be affirmed without hesitation that it constitutes a safe and profitable method for determining and taking advantage of undervalued situations."

Still, a lot of investors seem comfortable in their own complacency, not willing to change what they’re doing despite the evidence. These are the same investors who don't look back at how their own returns have performed versus the market because they’re afraid what they’ll find.

Don’t spend another year earning mediocre returns. See how Net Net Hunter membership can radically reduce the time and effort it takes you to put together a high quality net net portfolio. Explore Net Net Hunter Membership.

Don’t wait, do it now.