Distressed Investing: How To Exploit Near Terminal Companies

Get our Essential Net Net Stocks Guide to understand this strategy in detail. Click Here.

If you’re like most investors, when you consider purchasing a stock, you tend to shy away from firms that appear to be at death’s door.

After all, you figure, isn’t that just throwing good money after all the bad that’s previously been dumped into the business? Instead, you choose to invest in companies with a good track record and rosy outlooks.

I’m here to tell you, though, that shunning distressed investing — buying stocks or bonds of obscure, troubled, even downright ugly firms — can cost you big.

Trouble, you see, is where big fortunes are made.

Keep reading to learn how you can profit from trouble like the pros, and we’ll break down the different distressed investing strategies available.

What Is Distressed Investing?

Distressed investing is the practice of buying stocks or bonds of firms that are facing significant business problems and are typically trading at very cheap multiples of earnings or net assets.

Business problems can come from many places. Debt is one of them. Highly leveraged companies quickly run into bankruptcy when revenues fall short.

Disruption also brings crisis. Nokia, Polaroid, and BlackBerry are examples of firms that were wiped out by new disruptive technology and never came back.

In addition, firms in cyclical industries face problems periodically. While, by definition, these problems are not permanent, highly leveraged cyclical companies are often out of the game by the time the cycle reverts.

Most investors hate problems, though, and so when they spot them, they run away, selling at any price to get out.

Why Would Anyone Want to Buy Troubled Companies?

When everyone’s looking for the escape hatch, stocks end up selling for very low multiples of earnings or below book value, and bonds also sell way below par.

Sometimes, at such low prices, even if things actually go from bad to worse, you could end up profiting.

Take Charlie Munger’s investment in Tenneco, where he made almost 15 times his money in a couple of years.

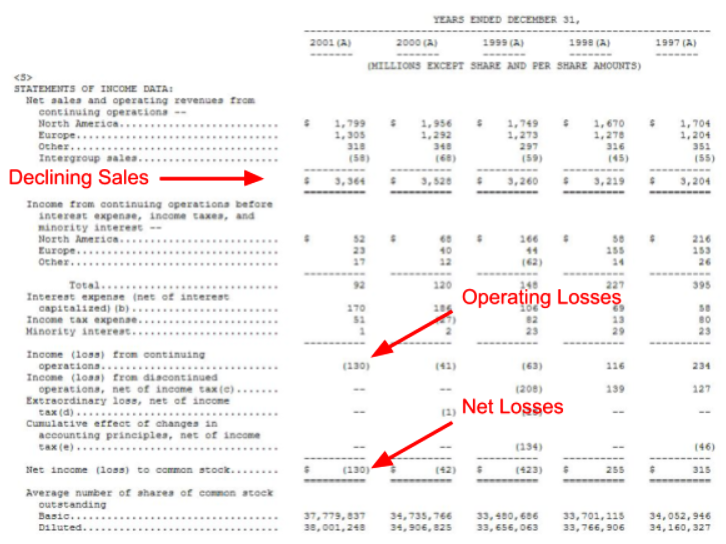

Tenneco is a major US auto parts supplier. In the late ’90s, revenue stalled while operating costs and interest expenses grew. Operating income fell from $395 million in 1997 to just $92 million in 2001.

The company was hemorrhaging red ink.

At the first whiff of trouble, investors fled, driving the stock from $10 to slightly below $2, while bonds sold at about 40 cents on the dollar.

Munger bought both the stock and bonds. If the company liquidated, his bonds would either be paid in full or converted to equity. Having bought them so cheap, he’d earn a profit in either case. On the other hand, if the company recovered even slightly, both bonds and stocks would rebound to pre-crisis levels.

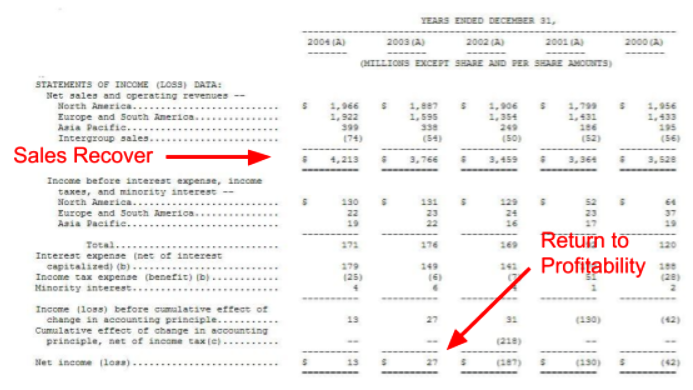

As it turns out, Tenneco went through a restructuring process and returned to profitability in 2003.

Investors quickly flocked back, eventually driving the stock price to about $15, earning Munger close to $80 million in profits.

When Warren Buffett ran his partnerships back in the ’60s, he too was fond of troubled companies.

He called them “cigar butts” because they resembled a soggy cigar butt left out on the street. You could pick it up, smoke the last puff for free, and then throw it away. It was disgusting, but it was all profit.

Buffett bought most of his dirt cheap stocks for prices well below liquidation value, meaning that even if the company liquidated, he’d earn a profit.

Carl Icahn also made his fortune back in the ’70s and ’80s out of these cigar butts.

Tappan was a cooking appliances seller. In 1977, during a downturn in the housing market, the company posted its first loss in years and the stock tanked, sending the price tumbling to one-third of book value of $20.

Icahn bought huge amounts of stock at these depressed prices and eventually got a seat on the board. Not long after, a competitor bought the company for $18 a share, netting Icahn a $2.7 million profit.

Bottom line is, if you buy cheap enough, profits will usually take care of themselves. Either the company recovers, or it is liquidated, or a competitor buys it, or good news create a temporary spike in the stock price.

It doesn’t matter to you, the savvy investor who bought low. You end up tossing the cigar butt away and reap the profits.

What’s the catch, though?

Is Distressed Investing Risky?

Most investors flee when they spot trouble, mistaking uncertainty for actual risk, and selling at whatever price they can get.

While buying at ultra-cheap prices means that, in theory, you could make money even if the company liquidates, the fact is liquidations are complex legal procedures, where the odds are not in your favor.

But Munger, Buffett, and Icahn all bought distressed businesses that still didn’t end up bankrupt. How come?

Bankruptcy is often the result of permanently declining sales coupled with high leverage.

What you want to look for to reduce the risk of bankruptcy is distressed businesses selling at dirt cheap prices with a healthy balance sheet, high liquidity, and a relatively stable business.

For example, Buffett’s cigar butts were usually companies facing significant problems but carrying little debt on their balance sheet.

But even if you buy a dirt cheap stock with little debt, things could still go wrong. For that reason, betting all your money on one particular stock is still risky.

Here’s the trick. More often than not, distressed businesses survive. That’s when diversification comes in handy.

If you buy a group of stocks in distress with a rock-solid balance sheet and good business prospects, you’ll pocket a decent profit with around 60-70% of your bets, while losing or breaking even with the other 30-40%.

Distressed Investing Strategies: Valuing Equity As an Option

Despite the risk, you can still profit with highly leveraged firms by valuing equity as an option.

Options are financial instruments that give their holder the right to either buy or sell an asset at a given price, at or before the expiration date. Their value depends, among other things, on the value of the underlying asset and its volatility.

In highly leveraged distressed firms, equity can be valued as an option.

How’s that possible?

If a company owes $80 and its assets are worth $100, but it hits a rough patch and its assets decline 50% in value, it is in trouble — technically, it has a negative book value.

But if the company only has to repay its debt in 10 years, then its equity is worth at least “something”.

How much?

Well, consider this. Shareholders can hold on to the equity before the debt is due, in the hope that the business turns around and the assets recover their value. This gives shareholders the option to profit from a business turnaround, and that option has a value.

Munger’s investment in Tenneco is a perfect example of valuing equity as an option.

Tenneco had a debt to equity (D/E) ratio of about 500% when Munger bought the bonds and the stock. But Tenneco didn’t have to repay bondholders until 2009 — it was long-term debt. If the business liquidated, Munger would get a nice profit on the bonds and only about break even with the stock.

But if Tenneco recovered, owning the stock gave Munger the option to profit from the upside as well — because debt was high, but long-term — while at the same time the reduced risk of liquidation would increase the price of the bonds, which is what eventually happened.

Now, this strategy requires ample business experience and financial expertise to properly assess bankruptcy risk and value the option.

Distressed Investing Strategies: The Deep Value Investing Approach

There are simpler ways to profit from distressed business situations.

Ben Graham spent his last years studying the returns available from various simple investing strategies. He summarized his conclusions in a speech called “Three Simple Methods of Common-Stock Selection,” where he said that buying a group of 30 stocks meeting a simple selection criterion (like low price-to-book value or low price-to-earnings ratio) — and selling at a 50% profit or after a two-year holding period — could earn investors very satisfactory results.

Stocks selling at low multiples — relative to one or another value metric — are usually facing some kind of business problem. They’re in distress, and we know what that means — everybody’s selling.

Nowadays, these are called “statistically cheap” stocks. Owning a portfolio of statistically cheap stocks over the long run is a winning strategy.

In statistics jargon, the population of cheap stocks — i.e., stocks selling at low multiples — outperforms the population of expensive stocks — i.e., stocks selling for high multiples.

Buying stocks with a low price to net tangible assets value (NTAV), for example, yields returns way above the market rate — between 15% to 20% a year, according to some studies.

According to Graham and confirmed by more recent studies, stocks selling at low price-to-earnings ratios (PER) tend to outperform the market as well, with a 15% return per year on average.

There’s also the Acquirer’s Multiple.

What’s the Acquirer’s Multiple?

The Acquirer’s Multiple (AM) is a valuation metric that compares the enterprise value of a company to its operating earnings. This is how investors who buy entire businesses usually look at their target companies.

A group of stocks selling for a low Acquirer’s Multiple earn around 18% a year. Not bad.

These are all impressive returns for distressed investing strategies, but there’s an even more profitable method available: net nets.

Best Distressed Investing Strategy: Net Nets

What are net nets?

Net nets are essentially low price to book value stocks where the value of fixed assets is excluded from the calculation. This is called the net current asset value (NCAV) — i.e., the value of current assets less all liabilities.

NCAV is a rough measure of the real world liquidation value of a company.

Now, who would sell an operating business for less than its “fire-sale” value?

Remember, most investors hate trouble. When everybody’s selling, chances are, you’ll get a price below NCAV. As you already know, more often than not, firms in distress recover. You just need a group of them to actually profit to come out ahead.

Most superinvestors have followed this distressed investing strategy with spectacular results.

For example, Buffett’s cigar butts were usually net nets back in the ’60s. He earned around 30% a year during his first two decades in business basically buying lots of these sub-liquidation stocks.

Munger also invested in net nets back in the ’60s and ’70s. He ran a very concentrated portfolio of this kind of stocks and earned above-average returns during that period.

Walter Schloss bought net nets whenever he spotted them during his 40-year-long investing career and beat the market accordingly.

Peter Cundill, the famous Canadian superinvestor who successfully beat the market in the long run, also focused on net nets.

Typical returns on offer for a group of net nets are around 30% per year on average.

If bought wisely — that is, distressed stocks with healthy balance sheets and stable businesses — the risk of actually losing money with these bargains is very low in the long run. Yes, you’re likely to have large drawdowns along the way. You may need an iron stomach to navigate through long periods of underperformance.

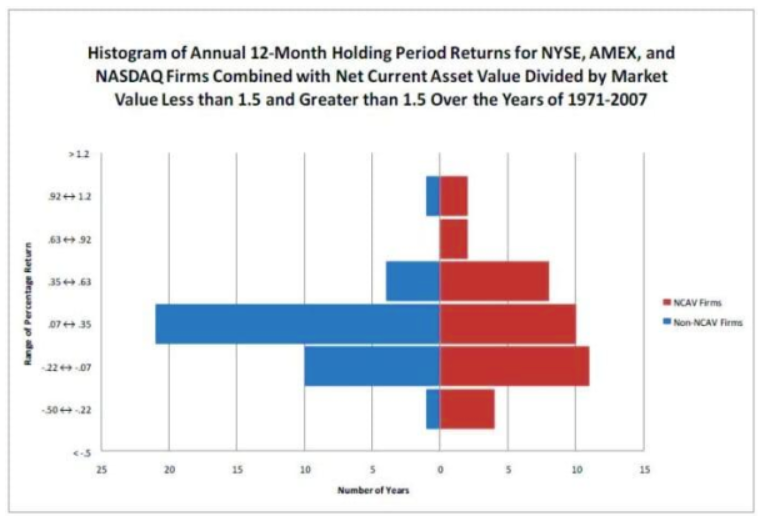

In the paper “NCAV Financial Distress Risk and Overreaction,” we can see the following graph:

Annual returns for the general indexes excluding net nets are in blue bars, and the red bars show the annual returns for the population of net nets. What you can see is that the general stock market had returns between 7% and 35% for 21 years, while net nets had only 10 years in that range. Net nets had big drawdowns of between -22% and -50% in 4 years, while the general market only had 1 terrible year.

This basically means that net nets have 4 times more big drawdowns than the general stock market, but the general stock market is twice as likely to have “average” years than net nets.

Now, what should really catch your attention are the bars on the top of the graph. As you can see there, the general market had annual returns between 35% and 120% in only 5 years, while net nets had 12 years of these spectacular returns!

It goes without saying that net nets are very volatile creatures. On average, though, gains will largely offset losses, and you’ll beat the average by a very wide margin — as long as you hold on to them through thick and thin.

One last thing about net nets is that they’re usually found among the small and micro cap universe. That’s a good thing, though. Most professional money managers just can’t waste their time studying them, no matter how profitable they are. This just means small private investors like us have less competition on that field.

If you’re a small private investor and want to start building your net net portfolio, it’d be worth your while to download Your Essential Guide to Net Net Investing, with more tips to stock your portfolio with the highest quality net nets worldwide.

Start putting together your high quality, high potential, net net stock strategy. Click here to get the free net net stock checklist.

Article image (Creative Commons) by Ian Stannard, edited by Net Net Hunter.