Have You Been Sucked Into the Warren Buffett Trap?

This will probably be the most controversial article on this website.

Warren Buffett is a legend among value investors -- and for good reason. His investment record is unmatched by any other investor who existed in the last 100 years. Value investors, understandably, have tried to emulate Buffett's approach to investing in order to snag a sliver of his returns. This typically means being glued to CNBC in the hopes of catching an interview, pouring over a mountain of books written about him, or combing through Warren Buffett's annual letters for nuggets of wisdom.

Unfortunately, trying to emulate Warren Buffett has led investors to adopt a less than ideal strategy.

Don't get me wrong. I like Warren Buffett -- a lot. I think he has a lot to teach investors. I appreciate his frank communication style and his generosity as a financial teacher. I just don't think that his contemporary investment style, one based around buying very profitable large cap companies with sizeable moats at fair prices, is the best strategy for people like you and me. Blindly adopting it after watching TV interviews, reading a couple books about the man, or taking a peek at his past record constitutes falling into the Warren Buffett trap. If you're sitting on a portfolio of less than $10 million USD then -- as those who have signed up to receive the free net net stock checklist ultimately know -- there are a lot better ways to make money in stocks.

Golden Nuggets From Warren Buffett

Now, I'm not trying to tell you that Warren Buffett is full of crap. Warren Buffett is incredibly intelligent with a far better investment record than I have (and, coincidentally, a lot more money, too) so I'm not trying to say that I know better than Buffett when it comes to investing. That would be silly. But, there is a large body of material out there in the form of interviews, his own articles, as well as his shareholder letters, and all of that has to be made sense of.

Let's start with the major pieces of advice that you should be taking from Warren Buffett. Buffett came from the Benjamin Graham school of investing and even today embraces most of its philosophy. Graham taught investors for years, for example, that a stock is just a fractional piece of ownership in a business. Its value is derived in large part from that business so a huge driving factor in earned capital gains when investing in stocks is tied to the performance of the underlying business. Warren Buffett still echoes that same principle. In his words:

If a business does well, the stock eventually follows.

I totally agree.

This also implies that a stock will fluctuate around it's intrinsic value, the business value that the stock represents. When taking the two investment principles together, it's pretty clear that volatility should be seen as a gift, something to take advantage of. This is exactly what Benjamin Graham's Mr. Market analogy highlights, an analogy Buffet has used many times in the past.

Warren Buffett's suggestion that you stay within your circle of competence is great. Having well defined boarders is really valuable when it comes to investing and will ultimately lead to better returns. Sticking to what you know means making fewer costly mistakes.

Speaking of mistakes, my favourite piece of advice Warren Buffett ever gave was his suggestion to follow two simple rules: 1. don't lose money, and 2. never forget rule number one. This piece of advice comes into my own investment strategy in a very powerful way, which I'll talk about more in a bit.

These are just a few nuggets of gold from Warren Buffett, and all are consistent with the principles that Benjamin Graham originally taught decades earlier.

The Warren Buffett Way

But, while Warren Buffett still embraces the fundamental philosophy of Benjamin Graham, he obviously employs a much different investment strategy than Benjamin Graham argued for years before. In fact, Warren Buffett's investment style has shifted considerably since the 1950s. Rather than look for classic Benjamin Graham value stocks as he did when he ran his investment partnership, Warren Buffett has turned to finding good businesses at decent prices. His stock selection process has become very simple and now consists of only 4 filters. Charlie Munger, Warren Buffett's partner in crime, sums it up this way:

We have to deal in things we're capable of understanding, and then, once we're over that filter, we have to have a business with some intrinsic characteristics that give it a durable competitive advantage, and then, of course, we would vastly prefer a management in place with a lot of integrity and talent, and then, finally, no matter how wonderful it is it's not worth an infinite price so we have to have a price that makes sense and gives a margin of safety given the natural vicissitudes of life.

I'm convinced that as those on the top of their game develop more skill and experience they are able to pack a lot more of their philosophy, tactics, or strategy, into their explanations, and use increasingly simple language to do so. Despite how simple Charlie Munger's description is, there's a lot packed into these principles that would have to be unwound for a thorough assessment of the Warren Buffett & Charlie Munger investment style. This is obviously beyond the scope of this article, but Munger's simple explanation goes a long way to identifying exactly what the pair do when selecting stocks.

Other soundbites and quotes fill in some of the missing pieces:

It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Buffett has turned to buying exceptional companies over the cheap marginal firms he once bought. The focus is very much on buying high quality businesses at adequate prices -- often a price far above what Benjamin Graham would have paid.

Our favorite holding period is forever.

Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years.

Warren Buffett also holds his investments for an exceptionally long time -- far longer than the bulk of every other "long term" Wall Street investor. While some professional managers talk about holding on to stocks for months or years, Warren Buffett talks about holding onto his investments for decades or for life.

Warren Buffett's popularity has attracted many new investors to the value investing philosophy. These investors typically get their first experience with value investing through the lens of Warren Buffett's contemporary investment style. Now long time value practitioners are witnessing an ocean of new value investors who seem to think that the best strategy for success is to buy firms with deep moats at adequate prices and to hold them forever. Typically this means buying medium or large cap companies that have been in the spotlight for years -- firms with market capitalizations that reach well beyond a billion dollars.

Unfortunately, this strategy is far from ideal, and could be outright dangerous.

Is Warren Buffett's Current Strategy Dangerous?

Well, not exactly. It really come down to who is trying to use Warren Buffett's current strategy.

As simple as the strategy sounds, actually employing it successfully is very difficult. Warren Buffett and other money managers, such as David Winters, draw on their long experience in researching and investing, as well as a business acumen oceans deep, to employ the strategy successfully.

Take assessing the talent and integrity of management, for example. Warren Buffett is great at assessing people. He's been investing for well over 60 years which means he's read thousands of financial reports and shareholder letters. He's also spent time managing businesses. Taking in this much data over the course of a lifetime, and being able to draw on practical business experience, means inevitably being able to spot trends and draw conclusions based on details that a typical retail investor might not even notice.

The same goes for judging whether a business has a strong competitive advantage or not. Of course, everybody can recognize a competitive advantage after it's been pointed out but picking them beforehand is a whole other story. Warren Buffett has spent thousands of hours diving into industry analysis and reading economic data, on top of his experience combing through thousands of annual reports, so his ability to spot the trends and characteristics that make for a strong competitive advantage is far more developed than even most professional money managers.

Think judging management or spotting strong competitive advantages is easier than I'm making it out to be? Even Seth Klarman doesn't think he can do it well -- and Klarman has one of the best investment records in the industry. From an interview with Charlie Rose,

I think Buffett is a better investor than me because he has a better eye for what makes a great business. And, when I find a great business I'm happy to hold it ...most businesses don't look so great to me.

Joel Greenblatt is a world class investor, as well. During his early career, by focusing on deep value and special situations, he reportedly racked up returns even larger than Warren Buffett did during his partnership days. On page 49 of Greenblatt's unfortunately titled book, "You Can Be A Stock Market Genius," he writes referring to Buffett's contemporary investment strategy,

The problem is that you're not likely to be the next Buffett or Lynch. Investing in great businesses at good prices makes sense. Figuring out which are the great ones is the tough part. Monopoly newspapers and network broadcasters were once considered near perfect businesses; then new forms of competition and the last recession brought those businesses a little bit closer to earth. The world is a complicated and competitive place. It is only getting more so. The challenges you face in choosing the few stellar businesses that will stand out in the future will be even harder than the ones faced by Buffett when he was building his fortune. Are you up to the task? Do you have to be?

Finding the next Wal-Mart, McDonald's, or Gap is also a tough one. There are many more failures than successes.

Once a company is selected, it still has to be valued. According to Warren Buffett,

Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life.

But it's also a calculation that mere mortals have a very difficult time using with any accuracy. It is very easy to be off by a small margin on any one of your assumptions that make up discounted cash flow. If you're off by more than a hair, you will inevitably be off on your assessment of intrinsic value by a large margin. As Buffett continues,

The calculation of intrinsic value, though, is not so simple. As our definition suggests, intrinsic value is an estimate rather than a precise figure, and it is additionally an estimate that must be changed if interest rates move or forecasts of future cash flows are revised.

Some investors might have the skill to be able to use discounted cash flow with some degree of accuracy, but I definitely don't. Before you decide to use Buffett's current strategy, you should take a hard look in the mirror to really admit to yourself whether you're able to perform a detailed discounted cash flow calculation with any degree of accuracy, yourself.

Typically, a margin of safety is there to absorb the errors you make, and guard against uncertainty. It's unfortunate, then that investors who are emulating Warren Buffett are electing to invest in wonderful companies at fair prices rather than fair companies at wonderful prices. Overestimating the value of a company can lead to significant losses. Just look at Coca-cola -- one of Warren Buffett's top investments!

What is sound in theory can sometimes have very painful consequences in practice; and, what lacks in theoretical accuracy can sometimes yield huge dividends in practice.

Should Skilled Investors Follow Warren Buffett's Current Investment Style?

Maybe. Clearly Warren Buffett's investment style suits Warren Buffett, so there must be other investors out there who would benefit from adopting his style -- but that investor is very unlikely to be you. Why? Very simply, Warren Buffett moved away from Benjamin Graham's investment style because his portfolio grew far to large to take advantage of classic Benjamin Graham investment opportunities.

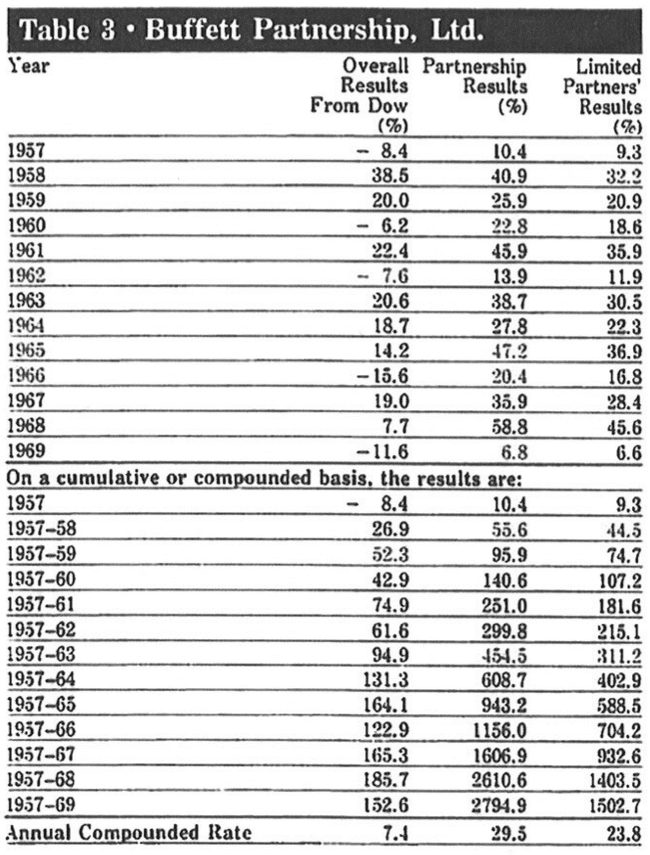

Warren Buffett used Benjamin Graham's investment strategy with tremendous success during the 1950s and 1960s. While he managed his investment partnership, he was able to rack up the best investment results of his career. Buffett was able to earn returns north of 20% over the course of his lifetime -- but just look at how well he was able to do using Benjamin Graham's investment approach:

Since leaving Benjamin Graham's investment strategy and growing his managed funds his returns have significantly decreased. Of course, you will probably bring up the point that the increase in the amount of money he was managing meant that his returns would inevitably suffer -- and you're right. But when asked what he wold do if he was managing small sums of money once again his answer was very telling (from GuruFocus):

The best decade was the 1950s; I was earning 50% plus returns with small amounts of capital. I could do the same thing today with smaller amounts. It would perhaps even be easier to make that much money in today's environment because information is easier to access.

You have to turn over a lot of rocks to find those little anomalies. You have to find the companies that are off the map - way off the map. You may find local companies that have nothing wrong with them at all. A company that I found, Western Insurance Securities, was trading for $3/share when it was earning $20/share! I tried to buy up as much of it as possible. No one will tell you about these businesses. You have to find them.

Other examples: Genesee Valley Gas, public utility trading at a P/E of 2, GEICO, Union Street Railway of New Bedford selling at $30 when $100/share is sitting in cash, high yield position in 2002. No one will tell you about these ideas, you have to find them.

The answer is still yes today that you can still earn extraordinary returns on smaller amounts of capital. For example, I wouldn't have had to buy issue after issue of different high yield bonds. Having a lot of money to invest forced Berkshire to buy those that were less attractive. With less capital, I could have put all my money into the most attractive issues and really creamed it.”

Notice that the examples he gives in this quote come straight from the investment strategy of Benjamin Graham -- they're very different from the way that Warren Buffett currently invests money. In fact, Warren Buffett often wrote about spectacular classic Graham investments. At a Berkshire Hathaway annual meeting held earlier this past decade, Warren Buffett answered a question which really spells out how he would invest if he wasn't handicapped with a large portfolio. Take a look:

Yeah, if I were working with small sums, I certainly would be much more inclined to look among what you might call classic Graham stocks, very low PEs and maybe below working capital and all that. Although -- and incidentally I would do far better percentage wise if I were working with small sums -- there are just way more opportunities. If you're working with a small sum you have thousands and thousands of potential opportunities and when we work with large sums, we just -- we have relatively few possibilities in the investment world which can make a real difference in our net worth. So, you have a huge advantage over me if you're working with very little money.

Click to see Warren Buffett's comment on video.

So getting back to the question above, whether you're a skilled investor or not is just one factor that comes into play in deciding whether you should adopt Buffett's contemporary investment style -- another huge consideration is the amount of capital you have to invest. If you're investing less than $10 000 000 then you would be much better off investing in the Graham styled bargains that Warren Buffett mentioned above -- provided that you want the highest possible returns for your money.

If you don't, that's fine. At some point a person wants to spend a lot less time and effort managing his or her own money. There's nothing wrong with that, and an index fund might be the next best choice.

How I Have Leveraged Warren Buffett to Yield Spectacular Returns in Classic Graham Stocks

Seeing as you're now reading an article on Net Net Hunter, it's pretty clear what strategy I've elected to use.

Not only has Benjamin Graham's investment strategy been shown to work exceptionally well in a number of academic studies, but it's also been used very successfully in practice by professional investors such as Walter Schloss, Benjamin Graham, Tweedy Browne, Seth Klarman, Peter Cundill, and -- of course -- Warren Buffett.

"My cigar-butt strategy worked very well while I was managing small sums. Indeed, the many dozens of free puffs I obtained in the 1950s made that decade by far the best of my life for both relative and absolute investment performance." - Warren Buffett, Berkshire Hathaway 2014 Shareholder Letter

How well does the strategy work? Academic studies consistently show returns of baskets of net net stocks in the 25-35% range. That's not just the results of a single study -- those results have been shown by each and every study I've looked at.

Right now I'm using a range of filters developed through a thorough study of Benjamin Graham, the scientific studies mentioned, and Buffett's own partnership letters. I've put all of this knowledge together into my NCAV investment scorecard and use that scorecard when assessing the merits of an investment opportunity.

Warren Buffett's influence has been profound. I've taken his advice to concentrate my portfolio and invest in the cheapest net net stocks possible to yield the highest possible returns. I've also kept his focus on not losing money front and center -- I screen out companies that have weak balance sheets which ultimately decreases the likelihood that any of my stocks will slip into bankruptcy. As a result, my portfolio returns have been great.

How have my net net stocks done? Over the last 3 years my portfolio has returned ~140% against the S&P 500's 41% return. As you can see, this strategy yields returns much higher than the market, and is ultimately a much better strategy than the one that Warren Buffett has been forced into.

Want similar returns? Start by signing up for a free net net stock essential guide. Enter your email address in the box below.

Read next: Why Guy Spier Rejected Warren Buffett's Investment Strategy