How Pro Cigar Butt Investor Jim Moore Finds Cigars

As Buffett has alluded to, buying good cigar butts stacks the odds of good returns in your favor, but what distinguishes the high quality and low quality cigar butt opportunities?

And, what about the investor keen to focus on Graham’s famous net net strategy rather than other cigar butts such as Ultra stocks? There is more than one way to approach Graham’s net net investing strategy, and it can really pay to buy the best opportunities in the market.

Cigars and Cigar Butts: A Low Quality Company and A Low Quality Cigar Butt Are Not The Same Thing

First, keep in mind that we’ll use the term cigar butt and net net interchangeably in this article, since most investors automatically think of net nets when they hear the term “cigar butt.” People often equate a good investment opportunity with a good business - but these are two different things. Consider Warren Buffett’s cigar butt analogy.

Buffett described net net investing akin to finding a used cigar butt with one free puff. You can light it up, take your puff, and then toss it. It won’t cost you a penny. The source of these free puffs, however, can be broken down further.

Low quality net nets are small cigar butts with just one puff left. The business is typically on its last leg (or in intensive care), but some event, announcement, or catalyst spurs a temporary pop in shareholder value - the free “puff.” The puff, however, is unlikely to be repeated. You take your puff (stock gains) and discard the cigar butt (sell the stock). In my experience and research, these types of businesses rarely permanently recover and/or take off to great heights. To expect so can cost you time and forgone returns.

On the other hand, high quality net nets are intact but unsmoked discarded cigars, offering many free puffs as opposed to just one. These businesses have significant value above the current market price, as well as reasonable business prospects. A high quality net net’s underlying business may also include a history of profitability, positive cash flow, heavy insider ownership, a share repurchase program (or current insider buying), etc.

Sorting The Cigar Butts From the Cigars

Benjamin Graham defined net nets as shares that trade at or below two-thirds of a company’s NCAV, or current assets less total liabilities (including off-balance sheet liabilities). A return to NCAV would thus lead to at least a 50% gain.

While this formula sets a great foundation for value investors, Graham probably didn’t expect his students/fans to dogmatically ascribe to it. The brilliance and importance of formalizing a deep value investing approach cannot be understated, but Graham likely had the overarching principle of “buy cheap” in mind – and an arbitrary formula that offers a framework to define “cheap.”

For those more interested in formulas, net nets can be broken down into subcategories of Graham’s framework but as another arbitrary quantification of the same “buy cheap” philosophy, and there are plenty more ways to subcategorize subcategories.

A low quality cigar butt can be quantified as: 1) a business with solid fundamentals trading above 67%+ of NCAV, or; 2) a business with poor fundamentals (and prospects) trading at or below 67% of NCAV. On the flip side, a high quality net net is a company with rock solid fundamentals, trading well below 67% of NCAV. This is how most net net investors would assess quality - but, as you’re about to see, initial assessments can be very misleading.

Given my previous discussion of high quality net nets, let’s look at how some seemingly low quality cigar butt opportunities can produce powerful returns.

1) High Quality, High Price Cigar Butts

It’s often hard to find net nets with attractive fundamentals selling at a 50% discount in an aging bull market. Most trade at 60% of NCAV, or 70% of NCAV, and so on. Despite being further up the valuation ladder, opportunities for good returns still exist. That said, I would classify these net nets as “low quality” net nets – high quality fundamentals, but higher priced stocks.

To increase the odds of good returns despite such “higher valuations”, you should demand more from the company’s fundamentals. Your margin of safety at 70% of NCAV, for example, is smaller than at 50% of NCAV so your margin of error for assessing the company’s operations is limited. Furthermore, solid company fundamentals such as profitability (current and historic), cash flow, and a healthy balance sheet can expand NCAV per share and your margin of safety.

Recent significant price declines can also help. When stocks fall hard and fast (50%+ drops), mispricings can occur. For companies with share prices over 67% of NCAV, share declines can be combined with how often the company’s share price has historically traded below NCAV. Many high quality businesses have not traded below NCAV in the past, or have done so infrequently. A rapid sell-off can lead to unprecedented valuation levels, and a rare buying opportunity for a quality company. This aligns perfectly with Net Net Hunter Scorecard.

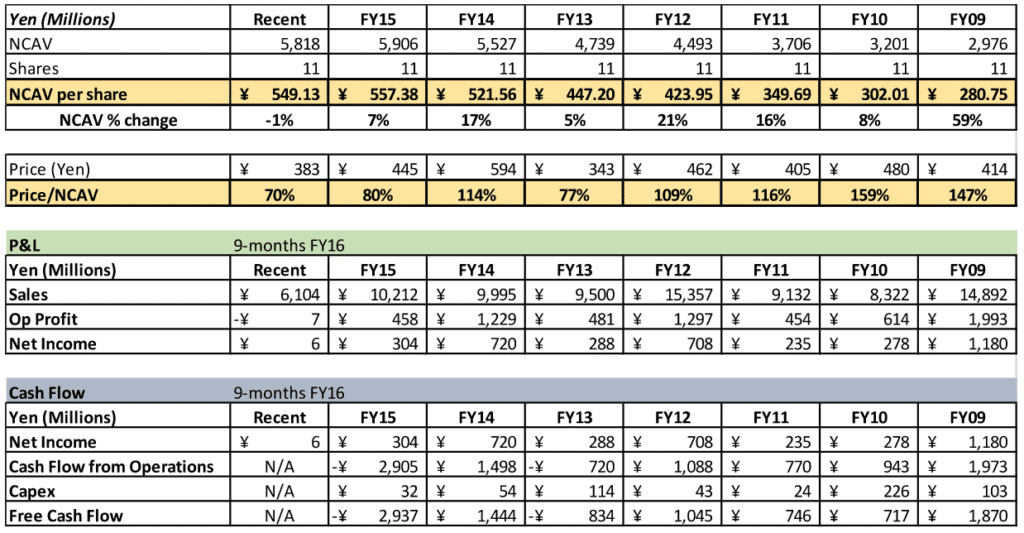

Techno Smart (6246): A High Quality Cigar Butt Opportunity

One high quality, “higher” priced, stock is Japanese-based Techno Smart, which manufactures industrial machinery. From peak to trough - 2014 to 2016 - the company’s shares declined by almost 50% while NCAV increased. Techno Smart was profitable, had a healthy balance sheet, growing NCAV, and a flat share count. Management had been in place for a long time and, despite negative operating cash flow a couple times in the previous seven years, cash flow was generally positive.

Techno Smart’s drop yielded a 70% price to NCAV by the time it hit my radar. While not extremely undervalued, the company’s shares typically traded above NCAV. A deeper discount is always preferable but Mr. Market rarely accommodates personal preferences.

Throughout 2016, Techno Smart improved sales and profitability, so market sentiment did a complete 180 degree turn. Shares snapped back to 100% of NCAV in a matter of months, and now trades at over 300% of NCAV - a 6x increase!

2) Low Quality, Low Price Cigar Butts

Then we have those companies that trade below 67% of NCAV with poor fundamentals. This scenario combines a cheap stock price and rapidly deteriorating NCAV, which could destroy the value that your investment is based on. But, an ugly duckling can generate attractive returns if the margin of safety is large enough. Everyone has their own comfort level, but I believe in these cases the margin of safety should be large enough to drive a truck through.

Companies trading below 50% of NCAV seem incredibly cheap, but I prefer buying these cigar butts below 40% of NCAV for even more cushion. As with all net nets, the lower the price to value the better. A net net with a 33% P/NCAV ratio can have its NCAV drop 50% and still leave a 66% P/NCAV ratio. The overarching point is to buy these types of net nets extremely cheaply after careful analysis.

The key to value investing is finding companies whose market price has declined faster than fundamentals. For what many dub “low quality net nets,” I believe that the price drop should be significantly greater than that of the fundamentals, for a large margin of safety. The true bargains in this approach are often found on the heels of a major fall off in price. Price declines that exceed 70% in a single year are not unheard of, nor uncommon, for these companies. In terms of fundamentals, many companies will have rapidly deteriorating balance sheets (double-digit NCAV declines), spotty track records of profitability, and negative cash flow – especially in recent years.

So where does the potential for returns lay? Companies with such deeply negative sentiment often need help, seek help, or receive unsolicited help (activism). To increase the probability of turning lemons into lemonade, look for potential catalysts (planned asset sales, cost reduction plans, strategic alternatives, buybacks, etc.). Cash burn and debt levels are also important. Although in many of these low quality, low price net net cases cash burn will be inevitable, the less the better. A high quick ratio (high liquidity relative to current liabilities), and an indication that cash burn is slowing (or has peaked) adds to the probability of survival while mounting debt, and increased borrowing lowers this probability. Pick up Net Net Hunter Scorecard for a comparable detailed checklist.

Lastly, as with any cigar butt, objectively low valuations create their own catalyst. If shares have traded below NCAV historically, the ideal candidates for low quality, low price net nets, in my view, are those that are hitting all-time low valuation levels. Depressed share prices often attract activist shareholders which can be a boon. Net Net Hunter members should read through this article in Net Net Hunter’s Resource Center for a much more in-depth look at buying these lucrative little stocks.

Rubicon Technology, Inc (NYSE: RBCN): This Soggy Cigar Butt Produced A Powerful Return

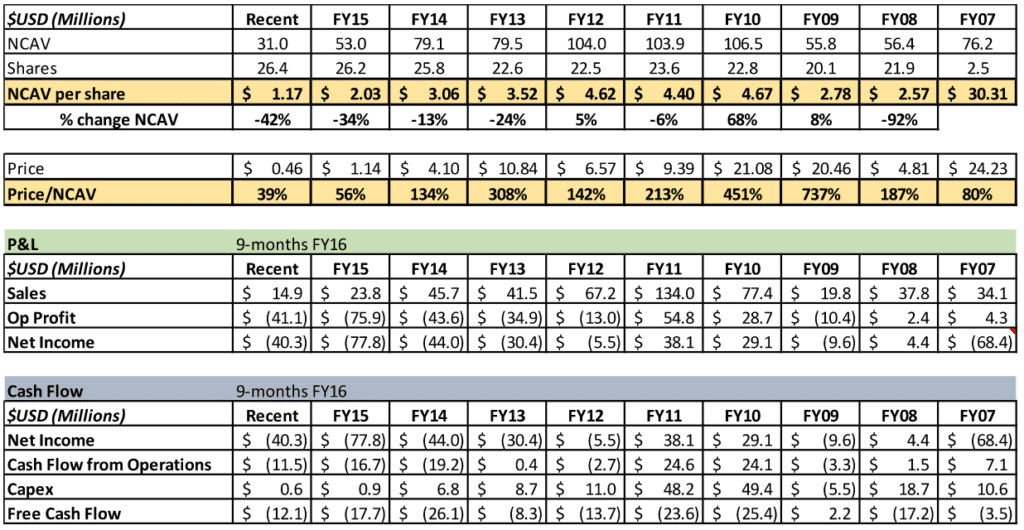

Rubicon Technology is a US-based manufacturer and seller of monocrystalline sapphire for applications and related products. Its shareholders experienced a roller-coaster ride from 2010 to 2017 as fundamentals improved then subsequently crumbled as demand for their core product ebbed and flowed - and then ebbed again.

In a span of two years through 2016, RBCN’s share price fell over 90% as the company hemorrhaged cash and posted large net losses. Over the same period NCAV per share declined by around 60%. Rubicon shares rarely traded below NCAV in the prior 10 years except for a period in 2007. Fundamentally, the situation appeared dire, and preserving shareholder value didn’t appear to be management’s strong suit. RBCN’s shares reached an all-time low in late 2016 with a Price to NCAV per share of just under 40%.

Despite their struggles, and on the heels of an activist’s failed proxy battle, management pursued cost cutting measures and the sale of a major manufacturing facility to stem the bleeding and bolster the balance sheet. Shares traded as low as $0.46 (a split adjusted price of $4.60) at the end of 2016 while NCAV per share was close to $1.20. The NCAV per share calculation did not include approximately $1.00 per share in book value for buildings owned by Rubicon being thrown in for nothing.

The massive discount to NCAV, and up to $1.00 per share for the manufacturing facilities, appeared to be enough to lure activist investors back in late 2016, and early 2017. Rubicon aggressively pursued the sale of their facilities and, despite the fact that the business' fundamentals, didn't improve much, the prospects for a shored up balance sheet was enough to help drive a price rally to over $1.00 per share at its high (a split adjusted price of over $10.00 per share). Investors who bought close to this terrible company’s low nailed a 100% gain.

Note: RBCN shares reverse split 10:1 in early 2017

When the Cigar Butt Smoke Clears

Variants to Graham's foundational cigar butt strategy produce returns as good or better than Graham saw. While back test after back test has validated blindly following the net net calculation as defined by Graham, analyses beyond the two-thirds of NCAV approach have merit and can help avoid errors of either commission or omission. High quality investment opportunities exist among stocks that investors usually dub high or low quality - they just have to be approached differently. At the end of the day, the linchpin in any strategy is the size of the margin of safety. Whatever your approach to cigar butt investing, the old adage that an investment “well bought, is half sold” will typically suffice.

Get the free net net stock essential guide. No obligation, no risk, no spam, just our free net net stock essential guide you can use. Enter your email address in the box below right now.

This is a guest post by Net Net Hunter member Jim Moore on how to conceptualize cigar butt investing. Jim operates a limited partnership out of New York and has been a guest speaker on net net investing at NYU's Stern School of Business, Fordham University, Bowdoin College, and the New York Society of Security Analysts. His research has been published in Bloomberg, Barron's, Fortune, CNNMoney, and MarketWatch. He’s been investing for 18 years, and has been a deep value investor for 8 years. For nearly a decade prior to running his partnership, he was an equities analyst on Wall Street covering software and tech stocks.

Article image by Leonidas Tsementzis.