International Value Investing? 5 Brokers You Have To Look At

Note: current as of August 2014

One of the most common questions I get from investors is which broker they can use to purchase international value stocks.

You already knows that net net stocks have delicious returns but value investing can be tricky in overpriced markets. To combat this, Net Net Hunter has focused its value investing activities in international markets -- currently Japan, plus major English speaking markets in Canada, Australia, Britain, and -- of course -- the USA. After finding great net net stocks, the next hurdle comes when it's time to buy. So, exactly what broker should you use when value investing internationally?

2 Global Brokers for International Value Investing

Choosing an international broker should be easy but there is enough variance in coverage between markets, and brokers that exclude US customers, to make selecting a broker fairly tricky. For the brokers I write about below, all of these firms are solid financially, cover a very wide range of markets, and all but one accept American customers. All of these companies have online trading in the majority of the markets they cover, as well, to make value investing easier.

Saxo Bank -- Let's get the one firm that bars American customers out of the way first. I included Saxo because they're located in a trustworthy country -- Denmark -- and because of the wide range of markets they cover. Investors can invest in: the USA (NASDAQ, NYSE, AMEX), Canada (TSX, TSX.V), Greece, Spain, Germany, Ireland, the UK (LON), Copenhagen, Finland, Sweden, the Netherlands, Brussels, Lisbon, Paris, Norway, Prague, Switzerland, Austria, Poland, South Africa, Australia, Hong Kong, Singapore, and Tokyo.

Saxo does not have any yearly, quarterly, or monthly account fees, and trading commissions are very reasonable. Trades start at the greater of 0.10% of the value of the securities bought or 12 Euros and work their way up to the greater of 0.3% or $25USD.

American and Canadian stocks trade for between the greater of 2 cents US per share or $15 and 3 cents Canadian per share or $25.

Fill your portfolio full of high potential, low risk, net net stocks. Click Here.

Interactive Brokers -- If you're an American interested in international value investing then you might want to look at Connecticut based Interactive Brokers. Actually, even if you're not an American you should probably still open an Interactive Brokers account.

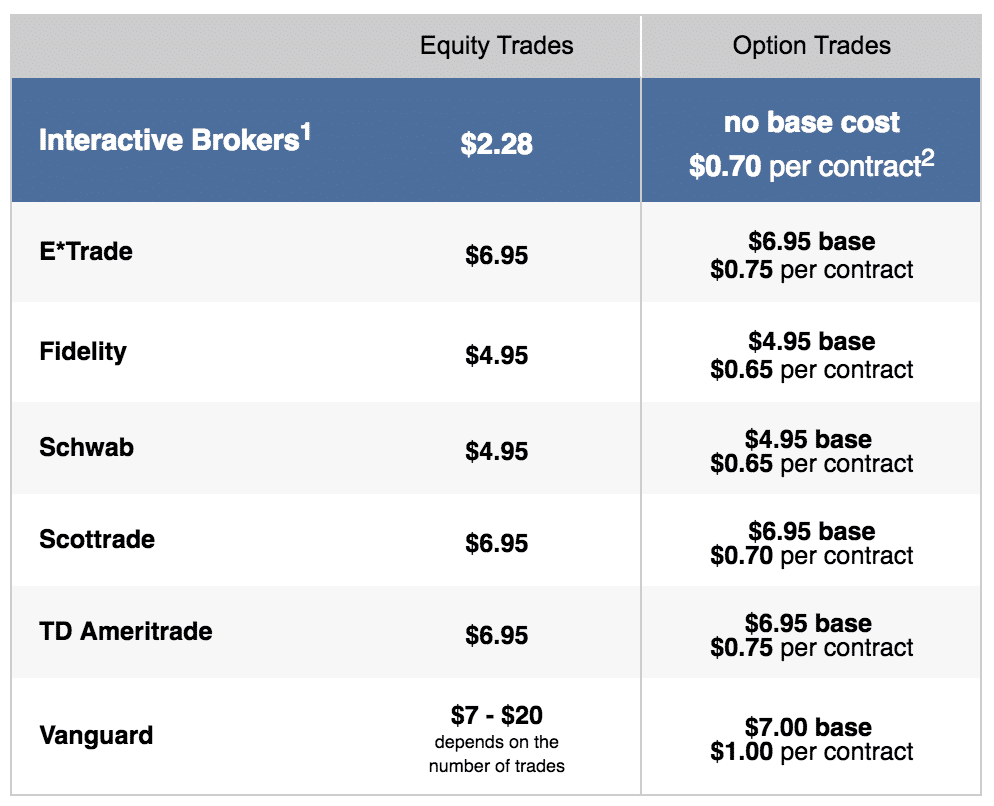

Interactive Brokers covers 26 markets in 19 countries making it highly likely that they will have the exchange you are looking for. Not only that, but trading commissions are the cheapest of any broker I've ever looked at. There's really no need to invest with anyone else.

Investors need to put a minimum of $10 000 into an account, or $5 000 if your account is an IRA.

It's not all roses, however. If you're intent on following investment best practices by trading infrequently, you'll end up paying a $10USD charge for each month that you fail to pull the trigger. If you trade in a given month, Interactive Brokers will deduct that commission from your inactivity fee. The only other downside to this fantastic broker is that they don't trade on all sections of the London Stock Exchange, making it difficult to buy some of the smaller firms.

Even still, the brokerage is probably the best you can use whether buying stocks at home or on international markets. You can trade pretty much any financial instrument you would want to -- stocks, bonds, options, etc. After using the brokerage for roughly 6 months now, I can say that the layout has become second nature, the tools (news, fundamentals, etc) have proven highly valuable, the customer service is actually pretty good (especially the live chat feature!)... and all of this for a rock bottom price.

I'm currently using Interactive Brokers as my main broker and can't recommend it enough.

Two Asian Market Specialists

OCBC Securities -- OCBC stands for Oversea-Chinese Banking Corporation but don't worry -- the firm is based in Singapore. Singapore has been a global financial centre for years now and is generally considered a modern capitalist country.

OCBC offers a wide range of markets in Asia: Hong Kong (HKEX), Indonesia (IDX), Malaysia (BURSA), the Philippines (PSE), Shanghai (SSE) & Shenzhen (SZSE B-shares only), Singapore (SGX), Thailand (SET), Tokyo (TSE), but also the U.S. (NYSE, AMEX, NASDAQ), London (LSE), and Australia (ASX).

Different account types are offered with different trading commissions charged. US citizens should note, however, that if you choose to use OCBC as your broker you wont be able to access US markets through them. All investors will also be charged a $20USD/mo custodian fee for holding international securities.

Monex Boom Securities -- This firm is another broker that specializes on Asian markets. The firm was originally called Boom Securities and based in Hong Kong but the company was recently purchased by Monex Group, one of Japan's largest online brokers.

As you might expect, the depth of coverage in Japan is impressive. Investors can trade on the Tokyo, Fukuoka, Nagoya, Osaka, and Sapporo exchanges -- far more than I've encountered with any other international broker. In addition, investors have access to markets in Australia, the Philippines, Malaysia, Korea, Indonesia, China, Taiwan, Thailand, Singapore, the US (the NYSE and the NASDAQ only), and Hong Kong.

Commissions are competitive with other brokers and yearly account fees are only $25USD.

One Western Dealer

Thales Securities -- The last on our list is Thales Securities based in Panama. The firm is registered by the National Securities Commission of Panama and includes a wide range of markets in Canada & the United States, not to mention Europe. It's coverage of the US markets includes the NYSE, NASDAQ, AMX, as well as ARCA. The only Asian market the firm offers investors is the HKEX located in Hong Kong.

While there are no yearly fees, investors are expected to generate 1% of their portfolios in commissions each year or the difference will be charged as an inactivity fee.

Keep These In Mind When Selecting An International Stock Broker

I hope this article goes at least part way to answering your questions about which broker to use if you're interested in internationally value investing. While this is a pretty good shortlist of brokers, you should only use this article as a basis for your own research to see if any of these brokers fits your own investment requirements.

Net net stock investors have to be particularly careful that the broker they select isn't just covering the largest markets in each country. Net net stocks are small companies and often trade on the secondary markets such as the NASDAQ, OTC, or TSX.V exchanges. If you're intent on building a net net stock portfolio -- like you should be! -- then you'll want depth of coverage over breadth of coverage.

As far as fees go, I've listed some but you should also make sure that, based on the size of your own portfolio, you're not selecting brokers who are going to charge you a sizable trading commission for each trade. A flat fee per trade rather than one based on the value of the trade, or a cap on commissions despite the size of the trade, should be a consideration. Also ensure that there are either no inactivity fees or that inactivity fees are very small.

One thing that frustrates me about my former broker is that I could only place same day trades for American Pink Sheets stocks. If you select a broker, make sure that all types of trades are available on each and ever exchange you could conceivably want to trade on. That way, when you find a net net stock you're interested in, you wont be charged for buying bits and pieces each day as you try to build a position.

How to Proceed

Great net net stock investment candidates can be tough to find. You can solve this problem by signing up for full Net Net Hunter membership. Not only do we have over 450 net net stocks to look at but we also dig through the listings to identify the best investment candidates. The money you could make off of even just one international net net stock would be enough to pay for full membership access for years.

Not ready for full membership? That’s fine. Just sign up for the free net net stock essential guide in the box below this article. No commitment, no obligation, and we keep your email address 100% confidential. Don’t wait. Sign up now so you can start making over 25% annual returns through net net stocks.